In a recent judgement, the ITAT Delhi ruled that, the correct amount of tax should be levied on the correct taxpayer in accordance with the law, and taxpayers must be given the opportunity to rectify honest mistakes made in their filings.

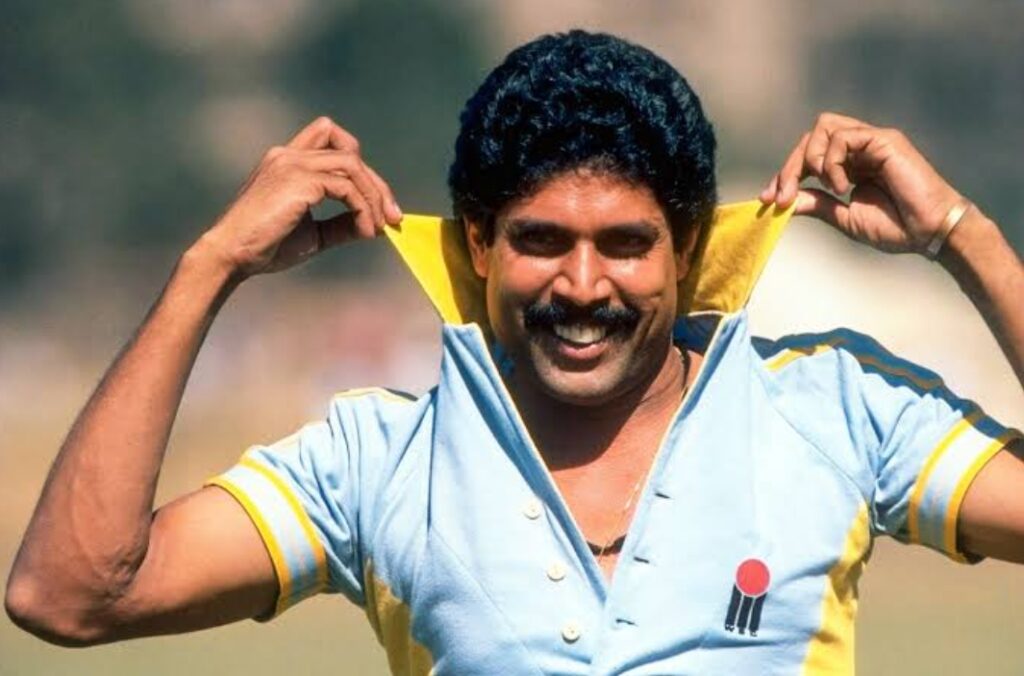

Case Title: Kapil Dev Nikhanj vs. Assistant Commissioner of Income Tax

Citation: (2025) 39 NYPTTJ 805 (Delhi Tribunal)

Key Highlights:

- Nature of Case: Appeal against rejection due to delay in filing and taxation of one-time benefit under Income from Other Sources.

- Main Issue: Whether the delay in filing appeal before CIT(A) was justified and whether one-time benefit received from BCCI is taxable under Section 56(2)(vii) of the Income Tax Act.

Background:

In this notable case, former Indian cricketer Kapil Dev Nikhanj voluntarily declared a one-time benefit received from the Board of Control for Cricket in India (BCCI) as taxable income in his income tax return. The amount was received as a token of appreciation for his distinguished service to Indian cricket.

However, following a series of favorable rulings from Income Tax Appellate Tribunals and a deeper understanding of Section 56(2)(vii) of the Income Tax Act, Kapil Dev realized that the said receipt should have been exempt from tax, as BCCI is a registered charitable trust under Section 12AA.

Appeal and Delay:

Acting on this updated legal advice, he approached the Commissioner of Income Tax (Appeals) [CIT(A)] after a delay of 1,993 days. The CIT(A), however, dismissed the appeal citing the inordinate delay.

Upon further appeal, the Income Tax Appellate Tribunal (ITAT), Delhi Bench, condoned the delay, accepting that the revised understanding of law based on judicial precedents constituted a reasonable cause. The Tribunal emphasized that when a taxpayer corrects a previously erroneous declaration in light of legal clarity, they should not be penalized.

Tribunal’s Observations:

- The one-time benefit from BCCI, being a registered trust under Section 12AA, qualifies for exemption under Section 56(2)(vii).

- Even if the taxpayer erroneously offered such exempt income to tax initially, the income must ultimately be assessed as per the correct legal provisions.

- The Tribunal reiterated that the Revenue cannot exploit the assessee’s lack of legal knowledge to collect taxes on exempt income.

Conclusion:

This decision underscores a crucial principle in Indian tax law: the correct amount of tax should be levied on the correct taxpayer in accordance with the law, and taxpayers must be given the opportunity to rectify honest mistakes made in their filings.

The ruling brings relief to several retired sportspersons and public figures receiving honorary or one-time benefits from recognized institutions and sets a precedent for condonation of delay in appeal filings, especially when backed by evolving legal interpretations.