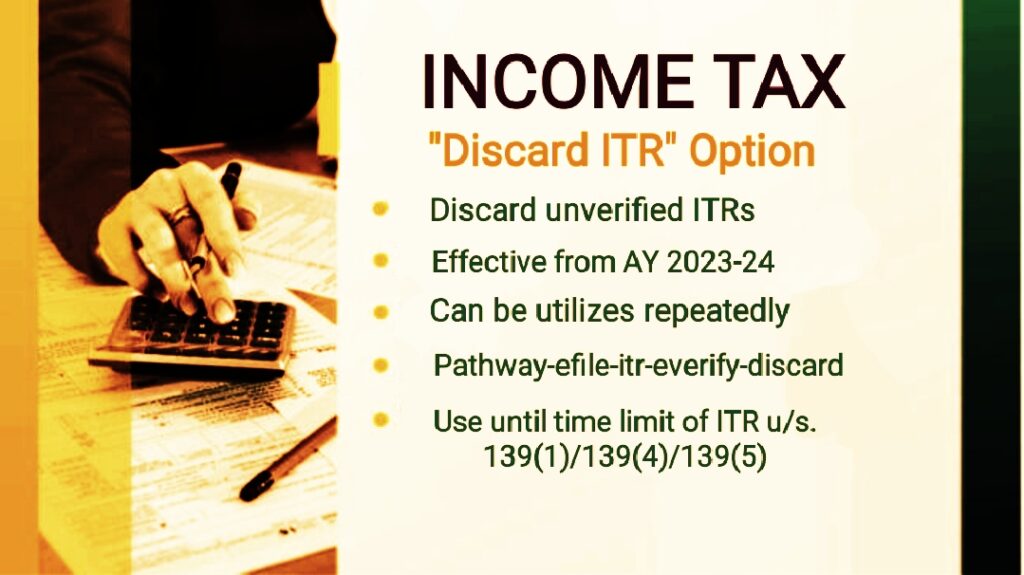

New Functionality ‘Discard ITR’ in the Income Tax Portal – Effective from AY 2023-24

In a significant development, the Income Tax Department has rolled out a pivotal feature ‘Discard ITR’ on its website, empowering taxpayers to discard previously filed but unverified Income Tax Returns (ITRs). This latest functionality goes beyond the traditional scope of ITR revisions, offering taxpayers greater flexibility in managing their tax filings.

Enhanced Revision Options

Previously, taxpayers were limited to revising ITRs only in cases of errors or omissions. The introduction of the ‘Discard ITR’ option for unverified original, belated, or revised ITRs, beginning from the assessment year 2023-24, marks a commendable step by the income tax department. This move significantly broadens the avenues for taxpayers to revise their returns, transcending the boundaries of mere correction.

Repeated Usage and Limitations

The ‘Discard’ option can be utilized repeatedly, provided the ITR status remains unverified or pending verification. This option, however, is exclusive to the assessment year 2023-24 onwards. Taxpayers can use this feature until the specified time limit for filing ITR under sections 139(1), 139(4), or 139(5), which currently stands at 31st December of the respective assessment year.

Once an ITR is discarded, it becomes irreversible and cannot be reinstated. Essentially, this action signifies a disclaimer that the ITR was never filed, providing taxpayers with a clean slate for a fresh submission.

Advisory and Implications

The income tax department has issued FAQs, clarifying that users can opt for the “Discard” feature for ITRs filed under sections 139(1), 139(4), or 139(5) if they choose not to verify them. However, if a discarded ITR filed under section 139(1) leads to a subsequent return filed after the due date, it may attract implications of a belated return, such as penalties under section 234F. Therefore, taxpayers are advised to check the due date for filing the return under section 139(1) before discarding any previously filed return.

User-Friendly Access

To access the ‘Discard’ option, users can navigate through the income tax website at www.incometax.gov.in. The pathway involves logging in, proceeding to e-File, selecting Income Tax Return, and then choosing the ‘e-Verify ITR’ option, where the ‘Discard’ feature is available.

Conclusion

This move by the Income Tax Department aligns with the evolving needs of taxpayers, offering them a more dynamic and user-friendly platform for managing their tax filings. The introduction of the ‘Discard ITR’ option reflects a commitment to simplifying and streamlining the income tax filing process, providing taxpayers with greater control and flexibility. As taxpayers explore this new functionality, it is crucial to be mindful of the specified time limits and potential implications, ensuring a seamless and compliant tax filing experience.

To Access the FAQs on “Discard ITR” issued by I-T department CLICK HERE

To Read about the “Prosecution provisions under Income-Tax Act” CLICK HERE

Read More