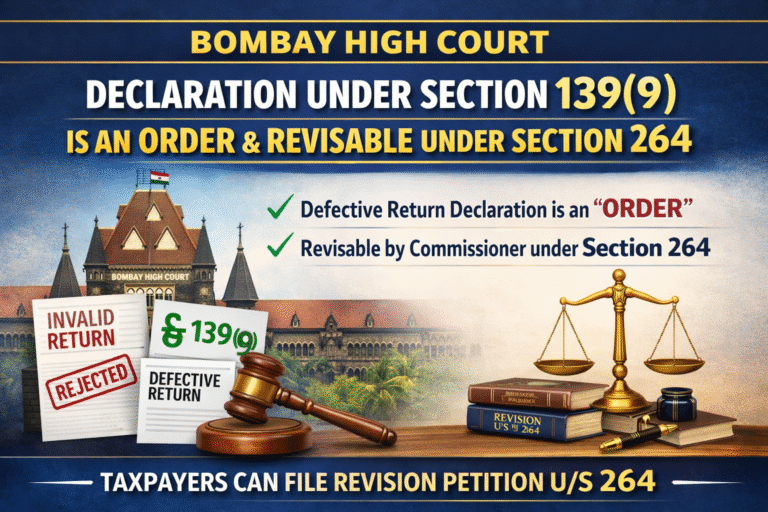

The Bombay High Court has held that a declaration issued by the Income Tax Department under section 139(9), treating a return as defective or invalid, is not merely an administrative communication but constitutes an order in law. The Court clarified that since such a declaration has serious civil consequences for the assessee, it is subject to revisionary jurisdiction under section 264. This ruling strengthens taxpayers’ remedies by confirming that defective return declarations can be challenged through revision before the Commissioner.

Citation

[2026] 183 taxmann.com 458 (Bombay)

Date of Judgment

03 February 2026

Date of Reporting

19 February 2026

WRIT PETITION (L) NO. 15292 OF 2024 (TPL – HGIEPL Joint Venture vs. Union of India).

Bench Composition

📌 The judgment was delivered by a Division Bench of:

- The Honourable Mr. Justice M. S. Sonak

- The Honourable Mr. Justice Jitendra Jain

Parties in the Petition

- Petitioner: TPL – HGIEPL Joint Venture (an unincorporated joint venture between HG Infra Engineering Pvt Ltd. and Tata Projects Limited)

- Respondents:

- Union of India (through the Secretary, Government of India, Ministry of Finance, Dept. of Revenue, North Block, New Delhi)

- Deputy Director of Income Tax, CPC, Bengaluru

- Assistant Commissioner of Income Tax, Circle 15(3)(1), Mumbai

Key Issue Before the Court

Whether a declaration issued under section 139(9) (treating a return as defective or invalid) can be considered an “order” and therefore be revisable under section 264.

High Court’s Ruling

The Bombay High Court held that:

✅ A declaration given under section 139(9) is clearly an “order” in nature.

✅ Since it affects the assessee’s rights and return validity, it cannot be treated as a mere administrative communication.

✅ Therefore, such an order is revisable under section 264.

Court’s Reasoning (Important Observations)

- The declaration determines whether the return will be accepted or treated as invalid.

- It has civil consequences for the taxpayer.

- Any decision impacting rights must be treated as an order, not a simple intimation.

- Hence, revision remedy under section 264 must remain available.

Practical Significance

This judgment is highly beneficial for taxpayers because:

🔹 If a return is declared defective/invalid under section 139(9), the assessee can file a revision petition u/s 264.

🔹 It ensures that taxpayers are not left without remedy against such declarations.

🔹 Reinforces that procedural declarations can still be challenged if they impact substantive rights.

Conclusion

Declaration under section 139(9) = Order → Revisable under section 264.