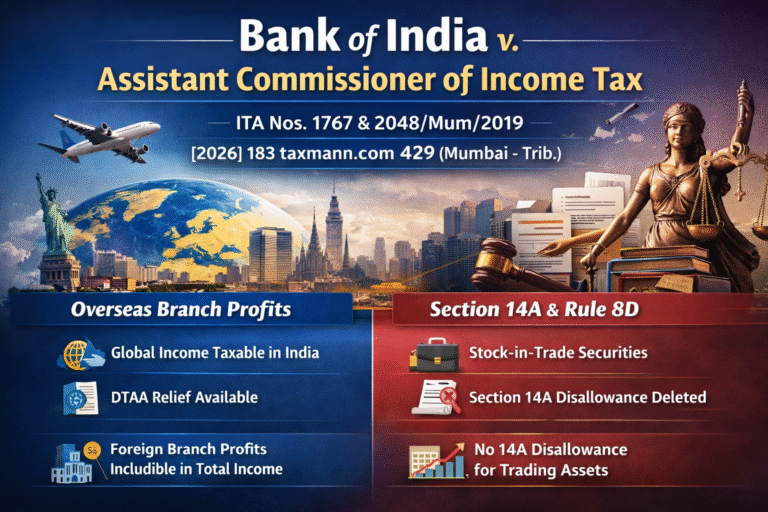

In a significant ruling in Bank of India v. Assistant Commissioner of Income Tax – ITA Nos. 1767 & 2048/Mum/2019, reported as [2026] 183 taxmann.com 429 (Mumbai – Trib.), the Income Tax Appellate Tribunal examined two important issues concerning the taxation of banking companies. The case dealt with (i) whether profits earned by overseas branches situated in countries having a Double Taxation Avoidance Agreement (DTAA) with India are includible in the total income of a resident assessee, and (ii) whether disallowance under Section 14A read with Rule 8D can be made when securities are held as stock-in-trade and exempt income is earned incidentally.

The Tribunal reaffirmed the principle that a resident assessee is taxable in India on its global income, including profits from foreign branches, subject to relief available under the applicable DTAA. At the same time, it provided clarity on the limited applicability of Section 14A in cases where securities are held for trading purposes and not as investments.

This decision offers valuable guidance for banks and multinational entities on the interplay between domestic tax provisions and treaty relief, as well as the scope of disallowance under Section 14A.

Background of the Case

The assessee, a banking company, had overseas branches situated in countries with which India has entered into Double Taxation Avoidance Agreements (DTAA). The key issues before the Tribunal were:

- Whether profits earned by overseas branches located in DTAA countries are includible in the total income of the assessee in India.

- Whether disallowance under Section 14A read with Rule 8D could be made where the bank held securities as stock-in-trade and earned exempt income.

Issue 1: Taxability of Overseas Branch Profits

Assessee’s Contention

- The profits of overseas branches were claimed to be exempt in India under the relevant DTAA provisions.

- It was argued that such income should not be included in the total income computed under the Income-tax Act.

Revenue’s Stand

- The Assessing Officer included the profits of the overseas branches in the total income of the assessee.

- Relief, if any, was to be granted in accordance with the DTAA provisions.

ITAT’s Ruling

The Tribunal held that:

- Under the Indian Income-tax Act, global income of a resident is taxable in India.

- Profits of overseas branches situated in DTAA countries are required to be included in the total income.

- However, the assessee is entitled to relief under the applicable DTAA (either exemption method or credit method, depending on the treaty).

Thus, inclusion in total income is mandatory, but double taxation relief must be granted as per treaty provisions.

Issue 2: Disallowance under Section 14A r.w. Rule 8D

Facts

- The assessee-bank held securities as stock-in-trade.

- It earned certain exempt income (such as dividend income).

- The Assessing Officer invoked Section 14A read with Rule 8D and made a disallowance.

ITAT’s Findings

The Tribunal observed:

- Securities were held as stock-in-trade, not as investments.

- The dominant purpose was trading, not earning exempt income.

- The exempt income was incidental to business operations.

Accordingly:

- Section 14A read with Rule 8D was held to be inapplicable in the facts of the case.

- The disallowance made under Section 14A was directed to be deleted.

Key Legal Takeaways

- Global Income Principle: A resident assessee is taxable in India on global income, including profits of overseas branches.

- DTAA Relief: Relief against double taxation must be granted under the relevant DTAA.

- Section 14A Not Automatic: Where securities are held as stock-in-trade and exempt income is incidental, Section 14A disallowance may not apply.

- Substance Over Form: The nature and purpose of holding securities is crucial in determining applicability of Section 14A.