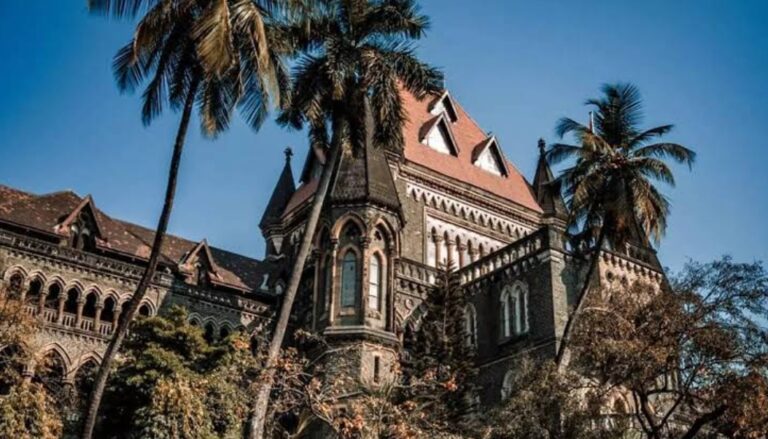

In a major relief for Go Digit General Insurance, the Bombay High Court has set aside a ₹170 crore tax demand raised by the Chennai South Commissionerate of GST & Central Excise. The court has also ordered a fresh hearing in the matter, as per the company’s regulatory filing.

The disputed amount includes ₹154.8 crore in tax and ₹15.48 crore in penalties for the period from July 2017 to March 2022. The High Court noted that the GST Council had already addressed similar issues and issued relevant circulars. Accordingly, the adjudicating authority has been instructed to reconsider the matter in line with these guidelines and conclude the proceedings within three months.

Go Digit, in its exchange filing, stated, “This issue primarily pertains to an industry-wide concern. We are currently assessing the legal implications of the order based on expert advice.” The company, however, clarified that it is yet to receive a formal copy of the court order.

This development follows a series of tax demands faced by Go Digit. Last year, GST authorities from Patna, Pune, and Ahmedabad had issued a combined demand and penalty order exceeding ₹26 lakh against the company.

Go Digit, which was listed on the stock market just a year ago, continues to demonstrate strong financial performance. The company reported a net profit of ₹116 crore in the fourth quarter of FY25, marking a significant 118.9% rise compared to ₹53 crore in the same period of the previous year. For the full financial year 2025, profit after tax soared 133.5% to ₹425 crore, up from ₹182 crore in FY24.

At 3:01 PM, Go Digit shares were trading at ₹334.50 on the National Stock Exchange (NSE).