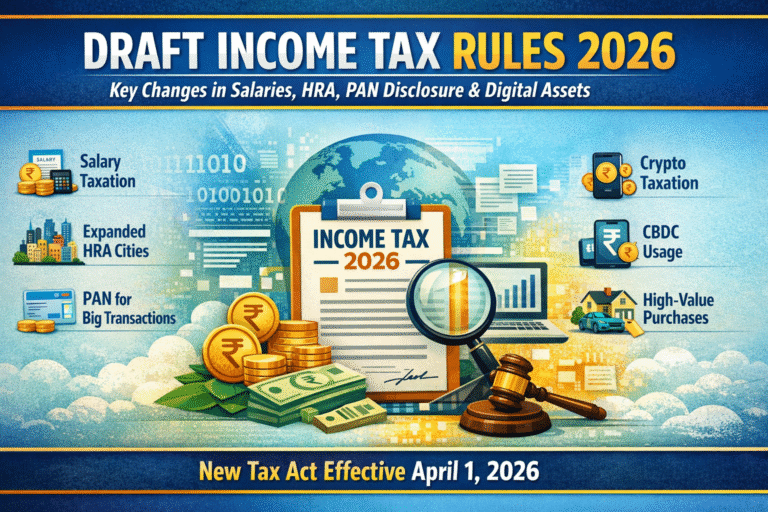

Draft Income Tax Rules 2026: Key Changes in Salary Taxation, HRA, PAN Disclosure & Digital Assets

The Draft Income Tax Rules, 2026, released by the Central Board of Direct Taxes (CBDT) in January 2026, mark a major step toward implementing the new Income Tax framework that will replace the six-decade-old Income Tax Act, 1961. These rules are …