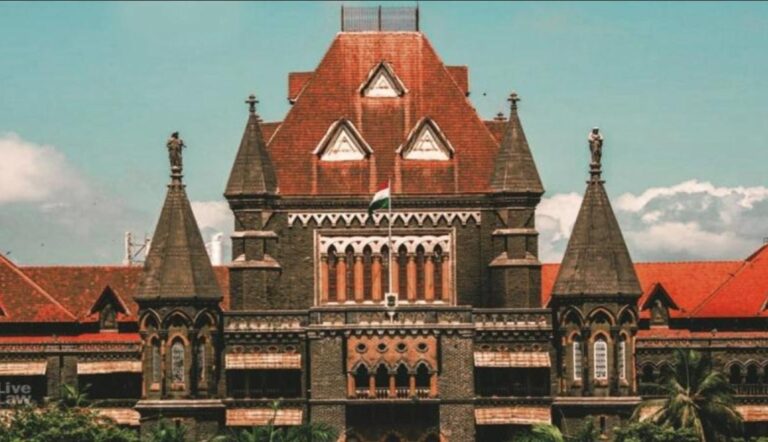

The Bombay High Court, in [2026] 182 taxmann.com 664, has reiterated an important procedural safeguard under the GST law by holding that clubbing of different financial years or tax periods while issuing a show cause notice under Section 74 of the CGST Act, 2017 is impermissible. The Court emphasized that proceedings under Section 74 are tax-period specific and that each period constitutes a separate cause of action, requiring independent determination of tax liability. The ruling reinforces the principles of natural justice and limits arbitrary consolidation of demands by GST authorities, particularly in cases alleging fraud, suppression, or wilful misstatement.

Issue

Whether the Department can club multiple financial years / tax periods and issue one consolidated show cause notice under Section 74 of the CGST Act alleging suppression, fraud, or wilful misstatement.

Facts (Brief)

- The GST Department issued a single SCN under Section 74 covering multiple tax periods / financial years.

- The assessee challenged the notice, contending that:

- Section 74 proceedings are period-specific

- Clubbing of periods is contrary to the statutory scheme

- Such consolidation prejudices the assessee’s right to defend period-wise allegations

Held

🚫 Clubbing of different tax periods / financial years in one SCN under Section 74 is NOT permissible.

Key Observations of the Court

- Section 74 contemplates determination of tax for a “particular tax period”, not multiple periods combined together.

- Each tax period gives rise to a separate cause of action, requiring:

- Independent examination

- Separate computation of tax, interest, and penalty

- Consolidated SCNs:

- Blur period-wise allegations

- Violate principles of natural justice

- Make it difficult for the assessee to give an effective reply

- The CGST Act does not provide any enabling provision allowing consolidation of multiple financial years under Section 74.

Decision

- The impugned show cause notice was quashed/set aside (to the extent it clubbed multiple periods).

- Liberty granted to the Department to issue fresh notices period-wise, if otherwise permissible in law.

Legal Principle Laid Down

There is no scope for issuing a consolidated show cause notice under Section 74 of the CGST Act by clubbing different financial years or tax periods.

Practical Significance

✅ Strong ground to challenge:

- Composite SCNs under Section 74

- Demands covering multiple FYs in one notice

- Notices lacking period-wise quantification

Useful especially in fraud/suppression cases where extended limitation is invoked.