In a significant judgment, the Uttarakhand High Court has ruled that any orders passed under Rule 96(10) of the CGST Rules, 2017 after its omission on October 8, 2024, are invalid due to the absence of a saving clause. This ruling comes as a major relief to businesses impacted by retrospective demands initiated under the now-deleted rule.

Background of the Case

The petitioner, M/s Sri Sai Vishwas Polymers, a partnership firm engaged in the manufacturing of gold bars and jewelry (classified under Chapter 71 of the Central Excise Tariff Act, 1985), challenged the validity of proceedings initiated under Rule 96(10) of the Central Goods and Services Tax Rules, 2017.

The firm had claimed IGST refunds amounting to ₹1,05,25,755, which were later questioned by the State GST Department after an audit. The department issued a show-cause notice, alleging contravention of Rule 96(10), and confirmed the demand.

Contentions and Legal Challenge

The petitioner contended that the continuation of proceedings under Rule 96(10), which stood omitted via Notification No. 20/2024-Central Tax dated October 8, 2024, was legally unsustainable. The petitioner further argued that there was no saving clause allowing pending cases to proceed under the omitted rule, and thus, all actions taken post-omission lacked legal backing.

On the other hand, the department maintained that since the rule existed when the show-cause notice was issued, the omission would operate prospectively, and therefore, proceedings already initiated would remain valid.

Court’s Observations and Ruling

A Division Bench comprising Chief Justice G. Narendar and Justice Alok Mahra noted that Rule 96(10) had already been declared ultra vires by the Kerala High Court in the case of Sance Laboratories Pvt. Ltd. vs. Union of India, reported in 2024 (91) G.S.T.L. 245 (Ker.).

The Uttarakhand High Court observed that the Central Government deleted Rule 96(10) without introducing any replacement provision or saving clause to protect ongoing proceedings. As a result, the Court ruled that all actions based on the said rule must cease from the date of its omission.

Key Takeaways

-

The omission of Rule 96(10) from the CGST Rules, 2017 was unconditional.

-

No saving clause was introduced to continue pending proceedings.

-

Any order passed or action taken under the omitted rule after October 8, 2024, is legally unenforceable.

-

The petition was allowed, bringing relief to the assessee.

Case Details

-

Case Title: M/s Sri Sai Vishwas Polymers v. Union of India and Another

-

Case Number: Writ Petition (MB) No. 103 of 2025

-

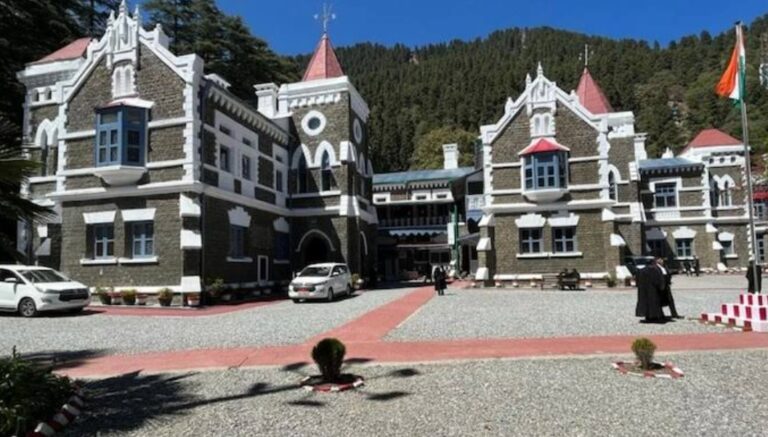

Court: Uttarakhand High Court

-

Judges: Chief Justice G. Narendar and Justice Alok Mahra

Conclusion

This ruling reinforces the principle that deleted statutory provisions cannot be enforced in absence of a saving clause. The verdict is expected to impact similar pending cases across the country where proceedings were initiated under Rule 96(10) of the CGST Rules post its omission.