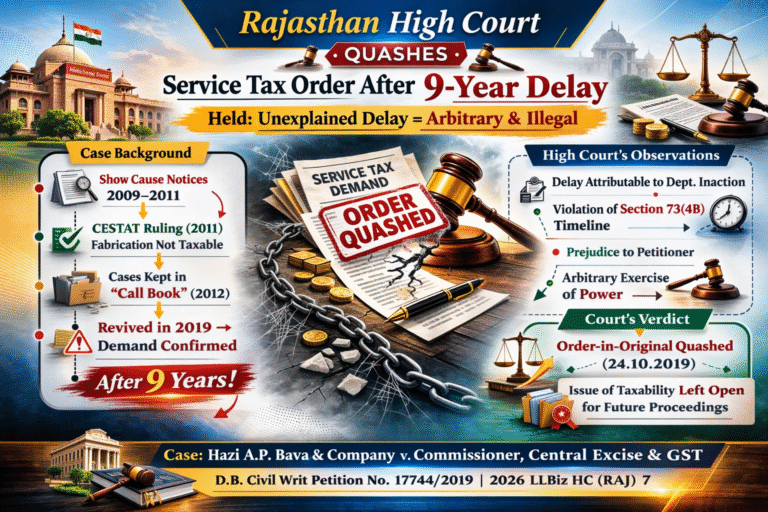

In a significant ruling reinforcing administrative accountability, the Rajasthan High Court set aside a service tax demand that was confirmed nearly nine years after the issuance of show cause notices. The Court held that such an extraordinary delay, caused entirely by departmental inaction, amounted to an arbitrary exercise of statutory power and violated principles of fairness and legal certainty.

Case Background

The matter arose in Hazi A.P. Bava & Company v. Commissioner, Central Excise and Goods and Service Tax (D.B. Civil Writ Petition No. 17744/2019 | 2026 LLBiz HC (RAJ) 7).

The petitioner, a proprietorship firm engaged in fabrication and erection of structures at clients’ sites using materials supplied by principal employers, had received multiple show cause notices between 2009 and 2011. The department alleged short payment of service tax by classifying fabrication work under “erection, commissioning or installation” as defined under Section 65(39a) of the Finance Act, 1994.

While an earlier demand for the financial year 2008–09 was adjudicated against the firm, the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) set aside the demand in December 2011, holding that fabrication activities did not fall within the taxable category.

Proceedings Kept in ‘Call Book’

Despite the favorable tribunal ruling, the department did not proceed to adjudicate the remaining show cause notices. Instead, in March 2012, the cases were transferred to the “Call Book,” effectively placing them in abeyance.

Although the department initially challenged the CESTAT order before the High Court, it later withdrew the appeal in September 2018 following the CBIC Circular dated July 11, 2018, which prescribed revised monetary limits for filing appeals.

Subsequently, the department revived the long-pending notices and, on October 24, 2019, passed an Order-in-Original confirming additional service tax demands along with interest and penalties.

Petitioner’s Arguments

Before the High Court, the petitioner contended that:

- The issue of taxability of fabrication had already been settled by the CESTAT decision.

- The tribunal’s order was never overturned and therefore remained binding.

- Revival of proceedings after nearly nine years was grossly delayed, time-barred, and arbitrary.

- The prolonged inaction caused serious prejudice and violated statutory timelines under Section 73(4B) of the Finance Act, 1994.

Department’s Stand

The department argued that:

- The CESTAT order was not accepted on merits and had been challenged before the High Court.

- Withdrawal of the appeal on monetary grounds did not amount to acceptance of the tribunal’s findings.

- Keeping the matter in the Call Book was justified pending the outcome of appellate proceedings in a similar matter.

High Court’s Observations

The Division Bench observed that Section 73(4B) of the Finance Act mandates that service tax liability must ordinarily be determined within:

- Six months from the date of notice in normal cases; and

- One year where the extended period is invoked, wherever possible.

The Court emphasized that even where the statute uses the expression “where it is possible to do so,” the department is still expected to act within a reasonable timeframe.

Rejecting the justification of keeping the case in the Call Book, the Court noted that unexplained administrative dormancy cannot justify reviving proceedings after an inordinate lapse of time. Such conduct defeats statutory discipline and undermines certainty in taxation.

The Bench categorically held that reviving proceedings after nearly nine years, without satisfactory explanation, amounts to arbitrary exercise of power.

Final Verdict

Allowing the writ petitions, the High Court quashed the Order-in-Original dated October 24, 2019. However, the Court clarified that the substantive issue—whether fabrication falls within “erection, commissioning or installation” under Section 65(39a)—was left open for determination in appropriate future proceedings.

Legal Significance of the Judgment

This ruling underscores important principles in tax administration:

- Authorities must adhere to statutory timelines.

- Prolonged administrative silence cannot prejudice taxpayers.

- Revival of dormant proceedings without justification violates fairness and certainty in tax law.

- The “Call Book” mechanism cannot be misused to indefinitely suspend adjudication.

The judgment serves as a strong reminder that procedural discipline is an essential component of lawful tax enforcement.