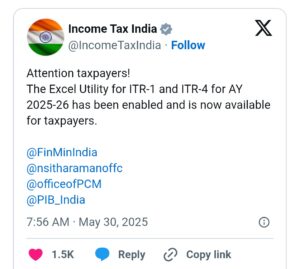

The Income Tax Department of India has officially released the Excel utilities for ITR-1 and ITR-4 for the Assessment Year (AY) 2025-26 (pertaining to Financial Year 2024-25). This announcement was made on May 30, 2025, through a post on its official social media platform X (formerly Twitter). The move marks the beginning of the income tax return filing season, enabling taxpayers to prepare and file their returns offline using Excel-based utilities.

✅ What is the Excel Utility for ITR Filing?

The Excel Utility is an offline tool developed by the Income Tax Department to facilitate income tax return filing without the need for continuous internet access. Taxpayers can download the utility from the official income tax e-filing portal, fill in the required data, validate the entries, and generate a JSON file, which is then uploaded to the e-filing website to complete the filing process.

Key Features of the Excel Utility:

- Works offline after download

- Pre-defined fields and validation rules to reduce errors

- Easy JSON file generation for uploading

- Supports import of pre-filled data from the e-filing portal

👥 Who Can Use ITR-1 Sahaj Form?

The ITR-1 (Sahaj) form is designed for resident individuals (excluding not ordinarily residents) who meet the following criteria:

- Total income up to Rs. 50 lakh

- Income from the following sources:

- Salary or pension

- One house property (excluding cases with brought forward losses)

- Other sources like interest from savings accounts, deposits, etc.

- Agricultural income up to Rs. 5,000

❌ Not Eligible to File ITR-1:

- Non-residents or individuals not ordinarily resident

- Individuals with income from capital gains or more than one house property

- Business or professional income

- Directors of companies or those who held unlisted equity shares

👥 Who Can Use ITR-4 Sugam Form?

The ITR-4 (Sugam) form is applicable to residents (Individuals, Hindu Undivided Families, and firms other than LLPs) opting for the presumptive taxation scheme under:

- Section 44AD (Small business income)

- Section 44ADA (Professionals like doctors, lawyers, consultants)

- Section 44AE (Income from goods carriages)

Eligibility Conditions:

- Total income should not exceed Rs. 50 lakh

- Business income under presumptive scheme (no regular books of accounts)

❌ Not Eligible to File ITR-4:

- Non-residents or LLPs

- Individuals with foreign income or assets

- Those earning capital gains

- Those who have income from more than one house property

- Regular books of accounts required under law

📥 How to Download and Use the Excel Utility

- Visit the official portal: www.incometax.gov.in

- Go to the “Downloads” section and select the relevant assessment year (2025-26)

- Download the Excel Utility for ITR-1 or ITR-4

- Fill out the necessary fields in the utility

- Validate the form using built-in checks

- Generate a .JSON file

- Log in to the portal and upload the file for submission

🗓️ Why Filing Early Matters?

Filing your income tax return early ensures:

- Faster processing of refunds

- Avoidance of last-minute errors and technical issues

- Ample time to correct discrepancies in Form 26AS or AIS

- Peace of mind and compliance with deadlines

📌 Conclusion

The release of the Excel utilities for ITR-1 and ITR-4 for AY 2025-26 marks a significant step towards enabling taxpayers to prepare for the new tax filing season. These utilities are especially useful for individuals and small businesses who prefer to work offline and maintain better control over their data.

Taxpayers are encouraged to download the appropriate form, understand their eligibility, and begin the return preparation well in advance of the due date to ensure a smooth filing experience.