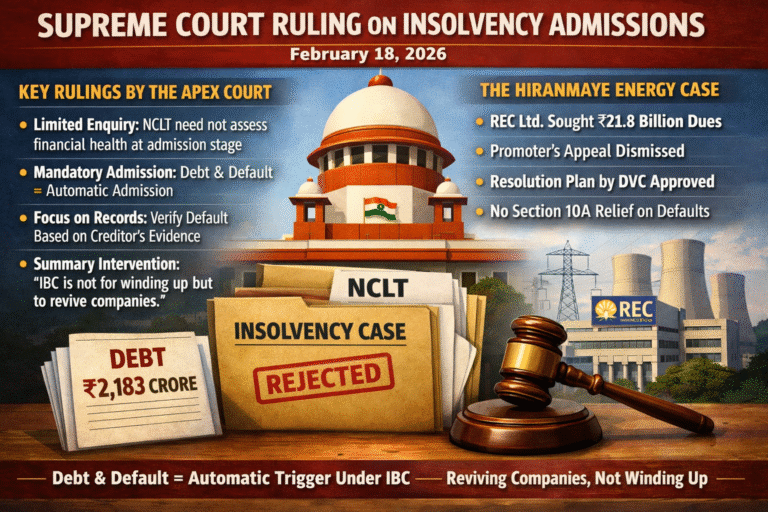

In a significant ruling dated February 18, 2026, the Supreme Court of India reaffirmed that the National Company Law Tribunal (NCLT) has a strictly limited and summary role while deciding applications under Section 7 of the Insolvency and Bankruptcy Code, 2016 (IBC).

The judgment restores clarity to insolvency jurisprudence and reiterates that the admission stage is not meant for a deep financial analysis of the corporate debtor.

🔹 Key Takeaways from the Judgment

1️⃣ Limited Scope of Inquiry at Admission Stage

The Court made it clear that the NCLT is not required to examine the overall financial health of the corporate debtor. It does not need to determine whether the company is commercially viable or capable of repayment in the long run.

At the admission stage, the Tribunal’s role is confined to verifying:

- Whether a financial debt exists, and

- Whether a default has occurred.

2️⃣ Mandatory Admission Once Debt and Default Are Proven

If a financial creditor establishes the existence of a debt and default, the NCLT must admit the application. The Tribunal does not have discretion to reject the plea on equitable considerations or on the debtor’s claim of being a “going concern.”

This reinforces the principle laid down in the landmark decision of Innoventive Industries Ltd. v. ICICI Bank, where the Court held that IBC proceedings are a summary intervention mechanism.

3️⃣ Focus on Documentary Records

The Court emphasized that verification should be based on:

- Records from an information utility, or

- Other evidence furnished by the financial creditor.

The determination must be completed within the statutory timeline of 14 days.

4️⃣ IBC Is Not a Winding-Up Proceeding

The Court reiterated that insolvency proceedings under the IBC are not meant to function as winding-up proceedings. Instead, they are designed to:

- Trigger a time-bound resolution process

- Maximize asset value

- Facilitate revival where possible

The Hiranmaye Energy Case: Background

The ruling arose while dismissing an appeal filed by the promoter of Kolkata-based Hiranmaye Energy Ltd.

💰 The Debt Involved

REC Limited (formerly Rural Electrification Corporation) initiated insolvency proceedings over outstanding dues of approximately ₹21.8 billion (₹2,183 crore).

⚖️ Promoter’s Arguments Rejected

The promoter contended that:

- The company was a going concern, and

- It had the capacity to repay the dues.

The Supreme Court rejected these arguments, holding that once default is established, such considerations are irrelevant at the admission stage.

The Court also refused to entertain an offer to settle by paying only part of the outstanding dues, especially since the Committee of Creditors (CoC) had already approved a resolution plan submitted by Damodar Valley Corporation.

This reaffirmed the supremacy of the commercial wisdom of the CoC, a principle consistently upheld in IBC jurisprudence.

No Relief Under Section 10A

The Court further clarified that failed restructuring proposals do not alter or “reset” the date of default to bring it within the COVID-19 suspension period under Section 10A of the IBC.

This observation prevents misuse of pandemic-era relief provisions in cases where default had already crystallized earlier.

Conclusion

This ruling strengthens the foundational structure of the Insolvency and Bankruptcy Code by:

- Limiting judicial overreach at the admission stage

- Ensuring speed and certainty in insolvency triggers

- Upholding the commercial wisdom of creditors

- Preventing misuse of restructuring or pandemic-related defenses

By reaffirming that the NCLT’s role is summary and record-based, the Supreme Court has once again ensured that the IBC remains a creditor-driven, time-bound resolution framework — aimed at revival, not delay.