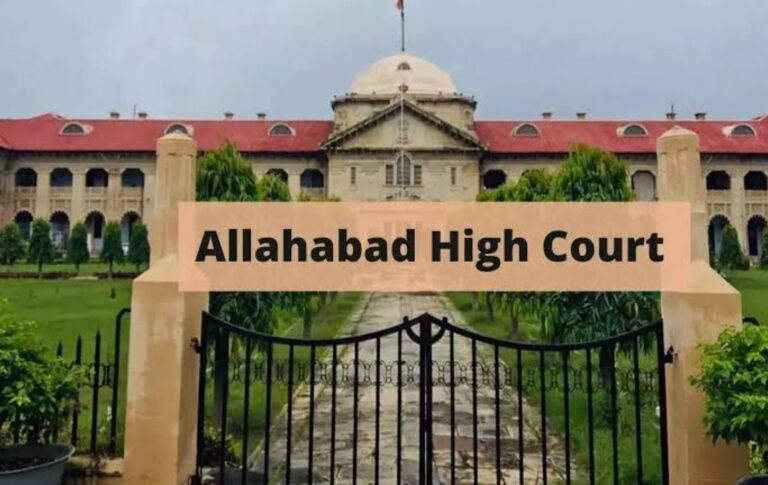

Allahabad High Court Quashes GST Assessment for Non-Issuance of Mandatory Notice Under Section 46

In a significant judgment reinforcing procedural compliance under GST laws, the Allahabad High Court has quashed the assessment and subsequent appellate orders against M/S Xestion Advisor Private Limited, a management consultancy firm, due to the failure of tax authorities to issue a mandatory notice …