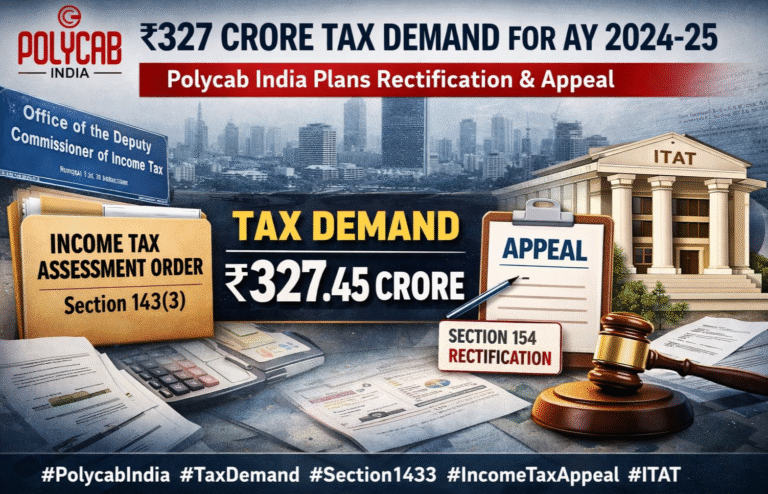

Polycab India Faces ₹327 Crore Tax Demand for AY 2024-25; Plans Rectification and Appeal

In a recent regulatory disclosure, Polycab India Limited informed stock exchanges that it has received an income tax assessment order raising a demand of approximately ₹327.45 crore for the Assessment Year (AY) 2024-25 (corresponding to FY 2023-24). The order has …