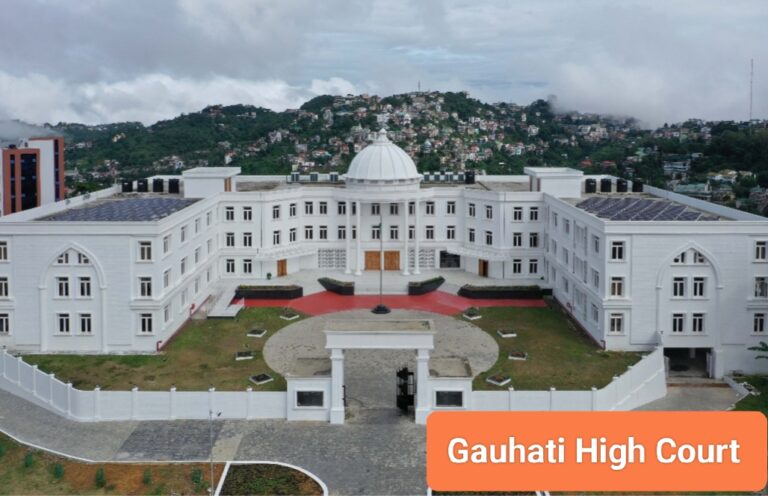

Gauhati High Court Ruling in case of Shree Shyam Steel vs Government of India

The Gauhati High Court has ruled in the case of Shree Shyam Steel Vs UOI [WP(C)/ 3838/2024] that the State GST Authorities cannot benefit from Notification No. 56/2023-CE, deeming it ultra vires the CGST Act, 2017. Justice Devashis Baruah noted that the GST Council has not made any recommendations regarding this notification. Despite this, the Central Board of Indirect Taxes and Customs (CBIC) issued Notification No. 56/2023-CE on 28.12.2023, extending the deadline for passing orders under Section 73(9) of the CGST Act, 2017 for the Financial Year 2018-2019 to 30.04.2024 and for the Financial Year 2019-2020 to 31.08.2024.

The bench observed that this notification does not align with Section 168(A) of the Central GST Act, 2017. If the notification cannot withstand legal scrutiny, any actions taken based on it would also be invalid. Section 168A allows the government to extend deadlines for proceedings and actions but requires GST Council recommendations, which were absent in this case.

The petitioners argued that the CBIC’s issuance of Notification No. 56/2023-CE is ultra vires Section 168A of the CGST Act, 2017. They pointed out that the GST Council’s 49th Meeting extended deadlines for earlier financial years, and the CBIC issued Notification No. 9/2023-CE on 31.03.2023 based on these recommendations. However, no new recommendations were made for the periods covered by Notification No. 56/2023-CE.

The petitioners maintained that without GST Council recommendations, the government lacks the authority to issue such notifications under Section 168A, rendering Notification No. 56/2023-CE illegal. They also noted that Section 168A is meant to be invoked only in cases of force majeure.

The State Department contended that under Section 11(4) of the Assam GST Act, 2017, only certain notifications related to Sections 11(1) and 11(2) can be adopted, and extensions like those in Notification No. 56/2023-CE are not covered. Therefore, state GST authorities cannot rely on this notification, which is also ultra vires the CGST Act, 2017.

The court granted the department time to present their position and evidence supporting their claim of force majeure. Meanwhile, the court provided interim protection to the petitioners, stating that no coercive action should be taken based on the assessment order dated April 26, 2024.

Also Read: GSTN Advisory on GSTR-1A: FAQs and Manual on Filing GSTR-1A

Read More

Fake ITC Cases involving Rs. 36,374 Crore Detected by CBIC in FY 2023-24