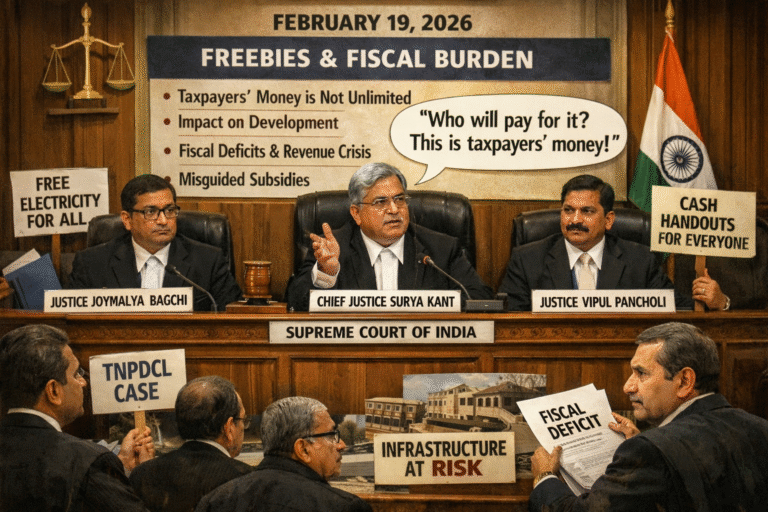

On February 19, 2026, the Supreme Court of India delivered strong oral observations on the growing trend of pre-election “freebies,” describing them as an “appeasing policy” that may impose an unsustainable burden on taxpayers and strain public finances.

A bench led by Surya Kant, along with Justices Joymalya Bagchi and Vipul Pancholi, raised serious concerns about the long-term economic and institutional impact of indiscriminate welfare measures announced by states, particularly ahead of elections.

“Free” Services Come at a Cost

During the hearing, the Chief Justice underscored a fundamental fiscal principle: no service is truly free. The Court observed that such schemes are ultimately funded through public revenue, meaning that the financial burden falls on taxpayers.

Questioning the sustainability of such policies, the bench asked, “Who will pay for it? This is taxpayers’ money.” The remarks signal judicial concern over fiscal responsibility and accountability in public spending.

Impact on Development and Nation-Building

The Court noted that large-scale distribution of subsidies and cash transfers—without clear targeting—could divert funds from essential long-term development projects. Investments in infrastructure such as roads, schools, hospitals, and public utilities may suffer if state resources are disproportionately allocated toward short-term populist schemes.

The bench emphasized that economic planning must strike a balance between welfare measures and sustainable development.

Need for Targeted Subsidies

A key issue flagged by the Court was the lack of distinction between beneficiaries. The judges criticized the practice of extending benefits—such as free electricity—to all citizens regardless of their financial capacity.

The Court indicated that subsidies should be carefully targeted toward marginalized and economically weaker sections who genuinely require state support, rather than being universally distributed without means-based criteria.

Rising Fiscal Deficits

Another major concern raised during the proceedings was the fiscal health of states. The bench observed that several states announcing expansive welfare schemes are already grappling with revenue deficits.

The Court questioned how such states could justify additional financial commitments without sound fiscal planning, hinting at the broader constitutional and economic implications of unchecked expenditure.

Concerns Over Work Culture

In a significant remark, the bench also touched upon the potential impact of universal freebies on work culture. It questioned whether direct cash transfers and universal free utilities might inadvertently reduce incentives for employment and productivity, thereby affecting economic growth in the long run.

Case Background: TNPDCL and Electricity Tariff Amendment

The observations were made in a matter involving the Tamil Nadu Power Distribution Corporation Ltd (TNPDCL). The corporation challenged a 2024 amendment to electricity rules that mandates tariffs reflect the actual cost of supply.

While the immediate dispute relates to electricity tariff regulations, the hearing expanded into a broader constitutional and fiscal debate on what the Court described as “irrational freebies.”

The issue is now slated for a detailed examination by a three-judge bench in March 2026, where the larger constitutional questions surrounding state-sponsored pre-election welfare schemes are expected to be addressed.

Broader Implications

The Supreme Court’s remarks come at a time when electoral promises involving free utilities, cash transfers, and subsidies have become increasingly common across states.

Though the Court has not yet issued a final ruling on the broader freebies debate, its observations suggest heightened judicial scrutiny of fiscal prudence, responsible governance, and equitable welfare distribution.

The upcoming hearing in March 2026 could shape the constitutional contours of state welfare policies and redefine the balance between electoral promises and economic sustainability.