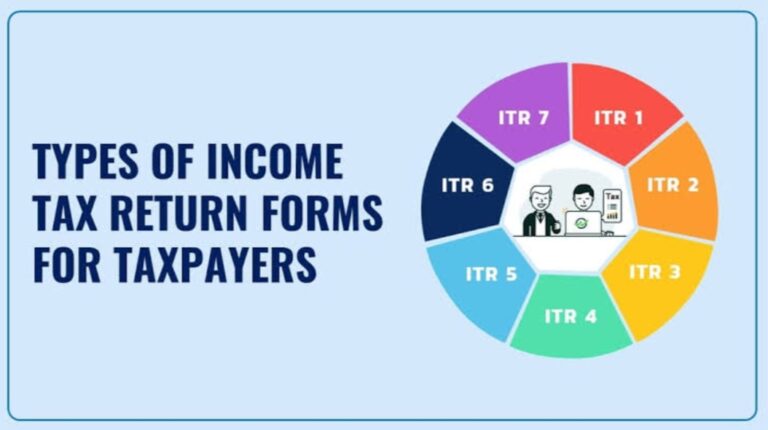

Applicability of itr forms for different persons for filing income tax return FY 2024-25

Knowing the correct ITR form is crucial for accurate income tax return filing. Using the wrong form can lead to rejection of the return, delays in processing, penalties, or even legal scrutiny. Each ITR form is designed for specific categories …