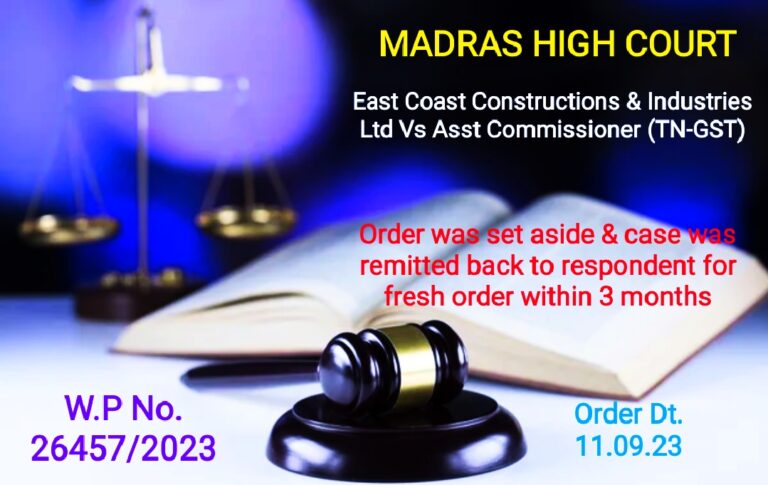

Madras HC Sets Aside the Order of Assistant Commissioner Due to Confusing Delivery of Order in GST Portal

In a recent legal development, technical issues on the GST portal have played a crucial role in case of East Coast Constructions and Industries Ltd (W.P.No.26457 of 2023) leading to the setting aside of Assessment Order by the Madras High Court by its ruling dated. 11 September 2023.

Facts of the Case:

The petitioner received an Assessment Order on 08.05.2023 due to their non-response to notices in Form GST DRC-01A and Form GST DRC-01. The petitioner’s primary grievance was the recent change in the GST portal’s notice communication placement, resulting in their failure to notice the critical notices of dated 19.08.2022 and 27.10.2022.

Petitioner’s Submission:

The petitioner highlighted that, historically, all notices were directed to the “View Notices and Orders” dashboard. However, a recent shift to “View Additional Notices and Orders” caused them to miss crucial communications. This oversight led to the petitioner’s failure to respond to the mentioned notices.

Respondent’s Submission:

The respondent argued that the writ petition lacked merit, asserting proper communication as per Section 169 of the Tamil Nadu Goods and Services Tax (TNGST) Act, 2017. The Additional Government Pleader recommended the petitioner pursue remedies under Section 107 of the TNGST Act, 2017, before the Appellate Authority.

Additionally, the Government pleader’s contention was that, the notices in Form GST DRC-01 dated 27.10.2022 specified a response deadline of 28.11.2022, providing ample time for the petitioner to reply. The respondent emphasized the optional postal communication, which, while unnecessary, was still conducted in this case.

High Court Judgment:

The High Court recognized a discrepancy in the petitioner’s details in Form GSTR-1 and Form GSTR-3B, stemming from deductions in Form GSTR-7. Acknowledging the need for clarification, the Court deemed it fair to grant the petitioner another opportunity. Consequently, the impugned order was set aside, and the case was remitted back to the respondent to issue a fresh order within three months.

The High Court directed the respondent to address the GST portal’s information hosting issue, emphasizing the importance of clear communication through the appropriate menus.

Conclusion:

The High Court’s ruling highlights the significance of resolving technical issues in the GST portal, ensuring proper communication of orders and fair treatment for taxpayers. This case serves as a reminder of the legal implications arising from communication discrepancies on the GST portal, urging authorities to streamline the process for effective notice delivery.

To Access the CBIC Instruction 5/2023 for GST Officers CLICK HERE

READ MORE

Suspension of Registration under GST as per Rule 21A of CGST Rules 2017