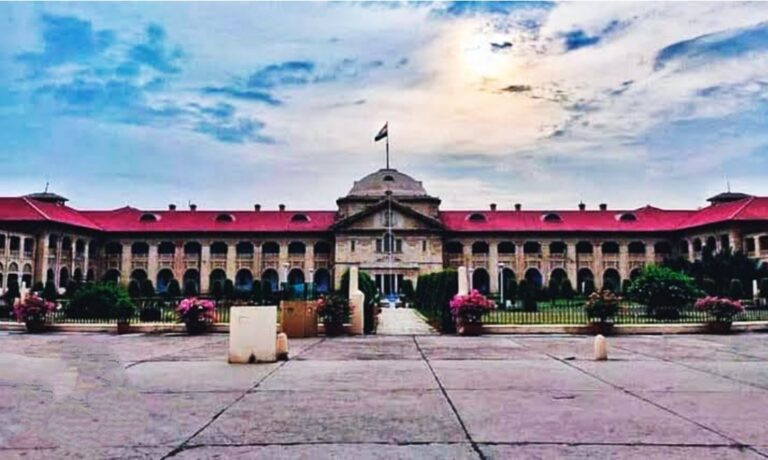

No relaxation in penalty under Section 129 of the GST Act, 2017 for the late submission of GST e-way bills: Allahabad High Court

In a recent ruling by the Allahabad High Court, for M/s. Jhansi Enterprises Nandanpura [Writ Tax No.1081/2019], it was determined that there would be no relaxation in penalty under Section 129 of the GST Act, 2017 for the late submission of GST e-way bills. The high court highlighted that although there were initial challenges in downloading e-way bills when the Goods and Services Tax regime was introduced in 2017, these issues were resolved by April 2018.

Justice Shekhar B. Saraf, in his ruling, emphasized that the mere submission of documents after interception cannot serve as a valid excuse to justify the non-production of documents at the appropriate time. There must be reasonable grounds to explain the delay in producing the necessary documents.

Background:

The case involved a registered dealer of TMT Bars (sariya) transporting goods to M/s Sahai & Sons, Orai, with the vehicle number MP 16H 1584 as stated in the tax invoice. When the goods were intercepted, an order for physical verification was issued under Section 68(3) of the Act due to the lack of documents produced during interception.

Following the verification order, the dealer presented the tax invoices and e-way bill. However, the authority rejected the e-way bill since it was generated after the interception, leading to a penalty under Section 129(3) being imposed. The subsequent appeal filed by the petitioner was also dismissed.

The petitioner’s counsel argued that due to the unavailability of the computer operator responsible for generating the e-way bill, the goods were dispatched inadvertently. They claimed that the e-way bill was actually downloaded at 2:45 pm, before the interception at 3:59 pm on the same day.

Court Ruling:

The Allahabad High Court examined the case and noted that the e-way bill was not presented during interception due to specific reasons. The court emphasized the need to assess whether there was a genuine intent to evade tax on the petitioner’s part.

Referring to a previous decision in M/s Akhilesh Traders V. State of U.P. and others, the court stated that the absence of tax invoices and e-way bills with the goods raises concerns about potential tax evasion intentions.

The court dismissed the petitioner’s claim that the truck was parked for unloading at the godown, citing lack of supporting details. Since the petitioner failed to refute the notion of tax evasion intentions, the penalty under Section 129 of the GST Act was upheld.

Conclusion:

This ruling reinforces the importance of timely submission of GST e-way bills and tax invoices for goods in transit. It underscores the responsibility of taxpayers to ensure compliance with GST Act regulations. For further information on the case, refer to the Allahabad High Court’s recent decision on penalty under Section 129 of the GST Act.

Also Read: Highlights of National Conference of Enforcement Chiefs Held on 4 March 2024

Read More

2 Similar Proceedings for same Period not Permissible under CGST/SGAT Act: Gauhati High Court

I was recommended this website by my cousin I am not sure whether this post is written by him as nobody else know such detailed about my difficulty You are wonderful Thanks

Thank you I have just been searching for information approximately this topic for a while and yours is the best I have found out so far However what in regards to the bottom line Are you certain concerning the supply