CAG Report Highlights ₹755.49 Crore Revenue Loss in GST Compliance by Commercial Tax Department

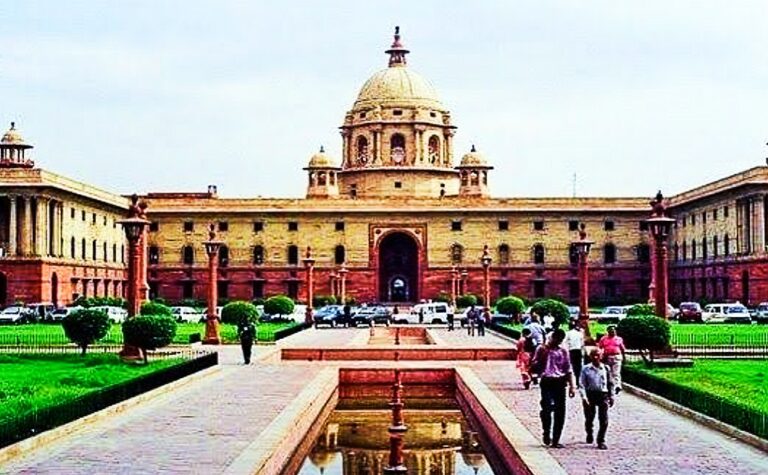

This CAG report underscores the critical need for stringent audits and immediate remedial action to curb revenue leakage. The Comptroller and Auditor General (CAG) of India has identified significant revenue losses amounting to ₹755.49 crore due to under-assessment, short levy, …