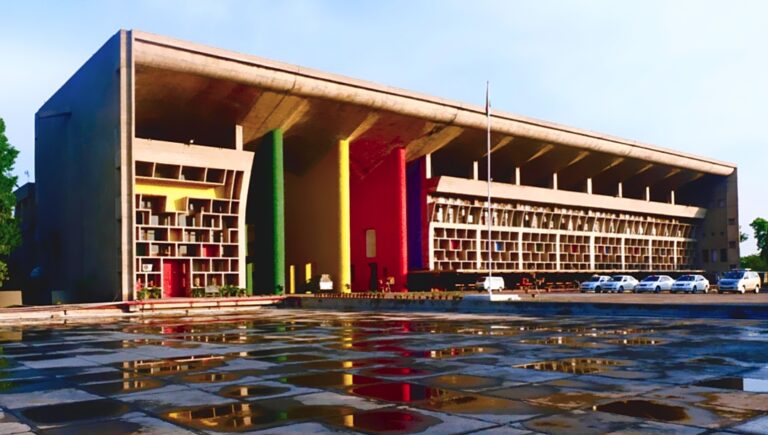

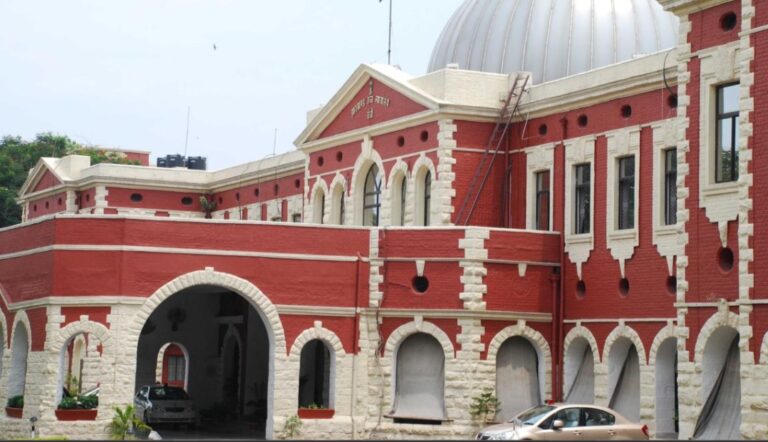

Punjab & Haryana High Court Restrains VAT Recovery After Assessment Records Destroyed in Fire

In a major relief for businesses facing legacy VAT disputes, the Punjab and Haryana High Court has barred the Punjab tax department from taking any coercive recovery action against a proprietorship firm after the State admitted that the VAT assessment record was destroyed …