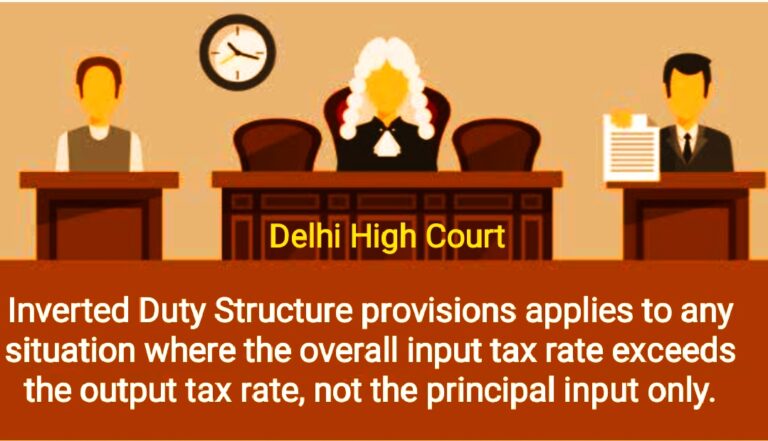

Delhi High Court Rejected the Interpretation of Inverted Duty Structure Provisions of Revenue Department and Instructed for ITC Refund to IOC by Considering the Overall Input Tax Rate

In a landmark judgment on December 5, the Delhi High Court delivered a significant blow to the narrow interpretation of the Inverted Duty Structure (IDS) provisions by the Revenue Department. The ruling, in favour of Indian Oil Corporation (IOC), not only clarified the application of IDS but also promised a more transparent Goods and Services Tax (GST) system for businesses across the country.

The dispute revolved around the Input Tax Credit (ITC) refund denied to IOC claimed under inverted duty structure. This structure arises when certain inputs have a higher tax rate than the final product. Despite the clear case, the Revenue Department rejected the refund, citing the similarity in tax rates between the principal input and output. The court intervened, instructing authorities to consider the tax rates of all inputs, not just the principal one, when processing the ITC refund.

Justices Vibhu Bhakru and Amit Mahajan presided over the matter, with IOC contesting against the Central GST Commissioner and others. The petitioner sought to claim a pending credit of over ₹15 crore, including interest.

The Delhi High Court rejected the narrow interpretation of the Revenue Department, emphasizing that the Circular relied upon exceeded the powers of the Central Board of Indirect Taxes and Customs, unable to override the clear provisions of the CGST Act. The court’s interpretation extended to the language of Section 54(3)(ii) of the Act, where the use of the plural “inputs” encompassed all inputs in the production process, not just the principal one.

Critically, the court criticized the Revenue Department’s focus on bulk LPG (principal input), stating that higher tax rates on other crucial inputs were the primary reason for the accumulated ITC. The judgment clarified that IDS provisions are not limited to scenarios where only the principal input and output have different tax rates. Instead, it applies to any situation where the overall input tax rate exceeds the output tax rate, irrespective of individual component rates.

Legal experts predict that this ruling will have far-reaching implications, benefiting industries beyond petroleum. Fertilizer, Vanaspati and Cooking Oil manufacturers, Acrylic yarn producers, and traders incurring costs on packing materials are among those expected to benefit. The broader interpretation of IDS ensures fairer treatment for businesses in diverse sectors, setting a positive precedent for the entire business landscape operating under the GST regime.

In conclusion, the Delhi High Court’s landmark decision not only secures IOC’s rightful refund but also establishes a foundation for fair and equitable treatment for businesses nationwide, ushering in a new era of transparency and clarity in the realm of GST.

To Read About the Process of Suspension of GST Registration CLICK HERE

READ MORE