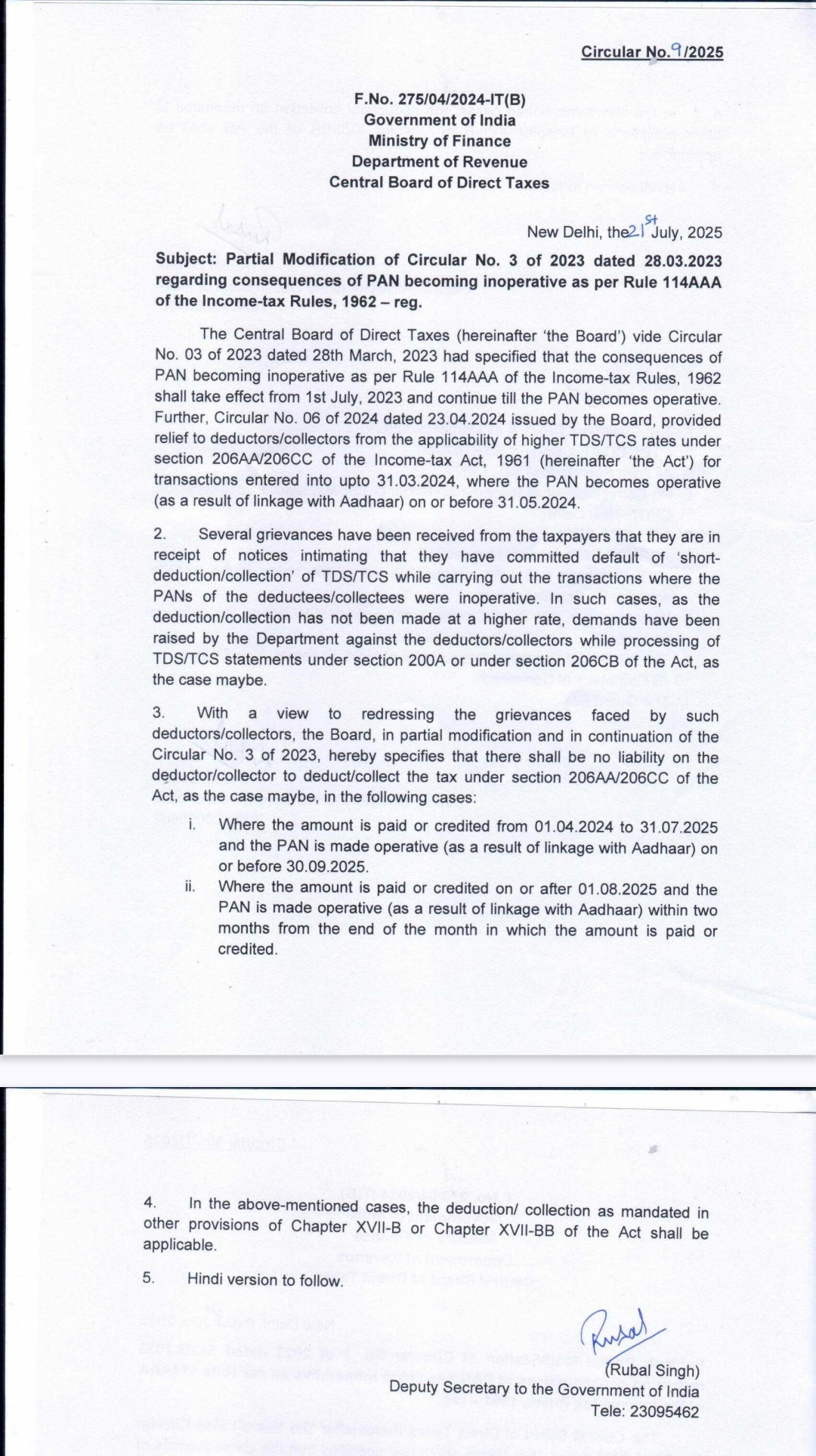

The Central Board of Direct Taxes (CBDT) has issued a crucial circular granting relief in cases where TDS or TCS demands were raised due to PANs being rendered inoperative because of non-linkage with Aadhaar. These demands typically arose during the processing of TDS/TCS statements where the deductor or collector failed to apply the higher TDS/TCS rates under Sections 206AA/206CC read with Rule 114AAA.

Key Relief Provisions Under the CBDT Circular

The circular clarifies that higher TDS/TCS rates will not be applicable in the following scenarios:

✅ Payments Made Between 01.04.2024 and 31.07.2025

If the payment or credit is made during this period and the PAN is subsequently made operative (by linking with Aadhaar) on or before 30.09.2025, the higher TDS/TCS rate will not apply.

✅ Payments Made On or After 01.08.2025

If the payment or credit is made on or after this date, and the PAN is made operative within two months from the end of the month in which the amount was paid or credited, the higher rate will not be levied.

⚠️ In both scenarios, TDS/TCS must still be deducted or collected as per the applicable provisions of Chapter XVII-B or XVII-BB of the Income Tax Act.

Conclusion

This move by the CBDT is a significant relief for deductors and collectors, allowing them to

avoid penal consequences where PANs were made operative within the prescribed timeline. It encourages timely Aadhaar-PAN linkage and provides a fair compliance window for taxpayers.