CBIC Circular 205/17/2023 Dated. 31 October 2023

CBIC Circular 205/17/2023: In its 50th meeting, the GST Council recommended a reduction in the GST rate to 5% for imitation zari thread or yarn, known by various trade names. This important clarification was made to ensure proper taxation in this sector. Subsequently, Sl. No. 218AA was added to Schedule I of notification no. 1/2017- Central Tax (Rate) dated 28.6.2017.

Key Question

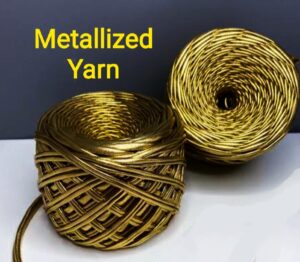

The main concern arising from this recommendation is whether metal-coated plastic film, when converted into metallized yarn and twisted with materials such as nylon, cotton, polyester, or other yarn, should fall under Sl No. 218AA of Schedule I (attracting 5% GST) or under Sl No. 137 of Schedule III (attracting 12% GST) as other metallized yarn.

HS Explanatory Notes

To address this concern, it’s important to consider the HS Explanatory Notes, which provide valuable insights. Heading 5605 covers a range of products, including yarn made of textile materials combined with metal thread or strip, whether produced by twisting, cabling, or gimping. It also includes yarn covered with metal through various processes, such as electro-deposition. This heading encompasses products with a core of metal foil (typically aluminium) or a core of plastic film coated with metal dust, sandwiched between layers of plastic film using adhesive.

To address this concern, it’s important to consider the HS Explanatory Notes, which provide valuable insights. Heading 5605 covers a range of products, including yarn made of textile materials combined with metal thread or strip, whether produced by twisting, cabling, or gimping. It also includes yarn covered with metal through various processes, such as electro-deposition. This heading encompasses products with a core of metal foil (typically aluminium) or a core of plastic film coated with metal dust, sandwiched between layers of plastic film using adhesive.

GST Council’s Recommendation

Considering the information from the HS Explanatory Notes, the GST Council recommends that imitation zari thread or yarn made from metallized polyester film or plastic film, falling under HS 5605, should be covered by Sl No. 218AA of Schedule I, attracting a 5% GST rate. This clarification helps in correctly categorizing these products for taxation purposes.

No Refund on Polyester Film (Metallized)/Plastic Film

Additionally, the GST Council has made it clear that no refund will be allowed on polyester film (metallized) or plastic film due to the inversion of tax rates. This change has been duly incorporated in notification no. 5/2017- Central Tax (Rate) through Notification no. 20/223-Central Tax (Rate) dated 19.10.2023.

Additionally, the GST Council has made it clear that no refund will be allowed on polyester film (metallized) or plastic film due to the inversion of tax rates. This change has been duly incorporated in notification no. 5/2017- Central Tax (Rate) through Notification no. 20/223-Central Tax (Rate) dated 19.10.2023.

In conclusion, this GST rate clarification ensures that imitation zari thread and metallised yarn made from polyester or plastic film under HS 5605 are subject to a 5% GST rate under Sl No. 218AA of Schedule I. It also addresses concerns regarding the refund of tax rates for polyester film, providing clarity in the taxation of these products.

To Read & Download the CBIC Circular 205/17/2023 CLICK HERE

To Read & Download the CBIC Circular 204/16/2023 CLICK HERE

To Read & Download the CBIC Circular 203/15/2023 CLICK HERE

To Read & Download the CBIC Circular 202/14/2023 CLICK HERE

To Read & Download the Notification No. 1/2017 Dt. 28.06.17 CLICK HERE

You May Also Like: