This Raid is a Part of an Extensive Investigation Against a Former MLA & MP Suspected in Significant Tax Evasion and Accumulating Disproportionate Assets

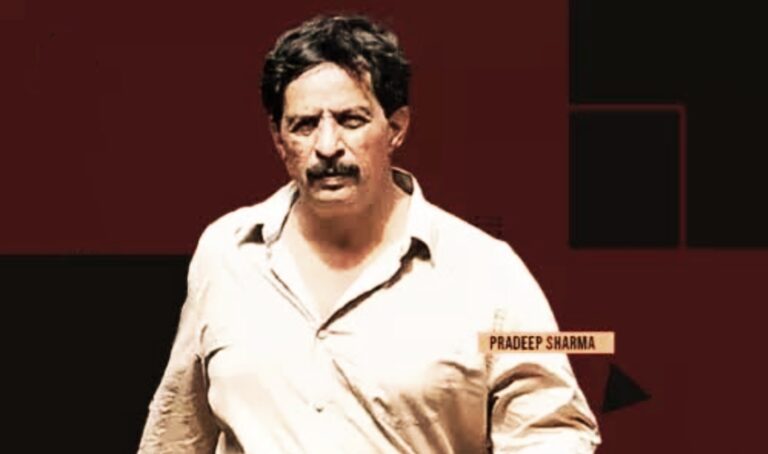

The Income Tax Department’s Investigation Wing recently carried out a raid at the residence of former Mumbai Police Officer and renowned Encounter Specialist, Pradeep Sharma, situated in Chakala, Andheri East, Mumbai.

Sources indicate that these raids are part of an extensive investigation involving a former MLA and MP, both suspected of engaging in significant tax evasion and accumulating assets disproportionate to their known sources of income.

Sharma’s residence came under scrutiny due to his associations with the aforementioned former politician and a bureaucrat, both of whom are subjects of investigation for alleged tax irregularities.

Notably, Pradeep Sharma was previously embroiled in the Antilia Explosive plant case and was arrested on charges related to the murder conspiracy of Mansukh Hiren. However, he secured bail from the Supreme Court last year. In 2019, Sharma contested the Maharashtra Assembly elections on a Shivsena ticket from Virar in Mumbai but was unsuccessful in his bid.

Notably, Pradeep Sharma was previously embroiled in the Antilia Explosive plant case and was arrested on charges related to the murder conspiracy of Mansukh Hiren. However, he secured bail from the Supreme Court last year. In 2019, Sharma contested the Maharashtra Assembly elections on a Shivsena ticket from Virar in Mumbai but was unsuccessful in his bid.

The Antilia Explosive plant case gained notoriety when an explosives-laden SUV was discovered near industrialist Mukesh Ambani’s residence in Mumbai on February 25, 2021. Mansukh Hiren, the owner of the vehicle, was subsequently found dead in a creek in Thane on March 5 of the same year, under suspicious circumstances.

The Income Tax Department’s raid on Pradeep Sharma’s residence underscores the seriousness of the ongoing investigation into alleged tax evasion and illicit wealth accumulation. As the probe progresses, further revelations are anticipated, shedding light on the complexities surrounding this high-profile case.

Stay tuned for more updates on this developing story as authorities continue to unravel the intricacies of financial improprieties and unlawful activities within the corridors of power in Mumbai.

To Know the Changes in New ITR Forms for AY 2024-25 CLICK HERE

Also Read

Capital Gain on Sale of Land as per IT Act 1961: A Comprehensive Guide