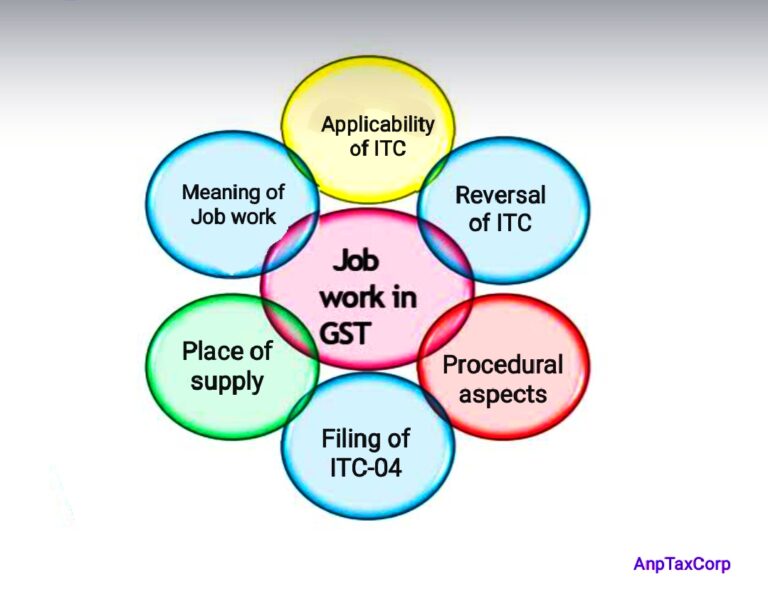

Introduction

In line with section 2(68) of the CGST Act 2017, job work refers to the process or treatment of goods conducted by one individual on behalf of another registered taxable person. The person carrying out the treatment or processing is known as the ‘job worker,’ and the rightful owner of the goods is termed the ‘principal.’ Moreover, the GST Act has put forth specific provisions concerning the movement of goods for job work and their return after processing, all without incurring any GST payment. It’s important to note that these provisions extend benefits to both the principal and the job worker, streamlining the job work process within the GST framework.

Applicability of Input Tax Credit on Goods sent on Job work

When it comes to the application of Input Tax Credit (ITC) on goods sent for job work, Section 19 of the CGST Act, 2017 lays down the provisions and guidelines for claiming ITC using Form ITC-04. Let’s delve into these provisions in a clear and concise manner.

When it comes to the application of Input Tax Credit (ITC) on goods sent for job work, Section 19 of the CGST Act, 2017 lays down the provisions and guidelines for claiming ITC using Form ITC-04. Let’s delve into these provisions in a clear and concise manner.

1. Input Tax Credit on Job Work Inputs:

The principal is eligible to claim input tax credit on the inputs dispatched to a job worker for the purpose of job work.

2. Direct Input Tax Credit for Inputs:

Even if the inputs are sent directly to a job worker without being brought to the principal’s business premises first, the principal can still avail input tax credit on them.

3. Timeframe for Inputs Sent:

If the inputs sent for job work are not returned to the principal within one year from the date of receipt by the job worker (if sent directly), it is considered that the inputs were supplied by the principal to the job worker on the day they were sent out.

4. Input Tax Credit on Capital Goods:

The principal is allowed input tax credit on capital goods dispatched to a job worker for job work.

5. Direct Input Tax Credit for Capital Goods:

Similar to inputs, the principal can claim input tax credit on capital goods even if they are directly sent to a job worker for job work without being first brought to the principal’s business premises.

6. Timeframe for Capital Goods Sent:

If the capital goods sent for job work are not returned within three years from the date of receipt by the job worker (if sent directly), it is deemed that these capital goods were supplied by the principal to the job worker on the day they were sent out.

7. Exemption for Certain Items:

The provisions in sub-sections (3) and (6) regarding the timeframe for return do not apply to moulds, dies, jigs and fixtures, or tools sent to a job worker for job work.

Conditions of Reversal of Input Tax Credit

Section 19 of CGST Act 2017 has prescribed some conditions, in violation of which the principal is required to reverse the ITC previously availed by him in a particular job work transaction. Let’s break down the conditions for the reversal of Input Tax Credit (ITC) into a clear format.

Section 19 of CGST Act 2017 has prescribed some conditions, in violation of which the principal is required to reverse the ITC previously availed by him in a particular job work transaction. Let’s break down the conditions for the reversal of Input Tax Credit (ITC) into a clear format.

1. Reversal of Input Tax Credit due to Non-return of Goods:

If the inputs or capital goods sent for job work are not returned by the job worker to the principal within one year or three years respectively, it is considered a “deemed supply” by the principal to the job worker. Consequently, the principal must reverse the ITC, equivalent to the credit previously availed on those specific inputs or capital goods. Additionally, interest will be charged from the date of this deemed supply.

2. Extension of Timeframe by the Commissioner:

The periods of one year and three years for the return of inputs and capital goods respectively may be extended by the Commissioner. If there is a valid reason, the Commissioner can grant an extension for a further period, not exceeding one year for inputs and two years for capital goods.

3. No Reversal Required for Dispatched Inputs or Capital Goods:

Importantly, the principal is not obligated to reverse the ITC taken on inputs or capital goods that were dispatched to the job worker for job work.

Job-work procedural aspects

1. Processing Continuity in Job Work:

1. Processing Continuity in Job Work:

Following the processing of goods, a job worker has the flexibility to pass on the processed goods to another job worker for further enhancements.

2. Efficient Goods Supply from Job Worker’s Premises:

The principal can streamline the supply of goods directly to a third party from the job worker’s location. This can involve payment of applicable taxes within India or for export, either with or without tax payment. This process requires the job worker’s premises to be officially declared as an additional place of business during registration, unless the job worker is already registered under GST.

3. Informing Authorities for Smooth Supply:

Ahead of supplying goods to the job worker, it’s vital for the principal to notify the Jurisdictional Officer about the specifics of the inputs to be sent and the intended processing tasks to be carried out by the job worker. This ensures a seamless workflow.

4. Proper Dispatch of Inputs and Capital Goods:

Inputs or capital goods are dispatched to the job worker under the cover of a challan issued by the principal, maintaining a systematic and organized process.

5. Waste Management in Job Work:

Waste generated during the job work process at the job worker’s premises can be managed efficiently. If the job worker is registered under GST, he can directly supply the waste from his business location, subject to tax payment. Alternatively, if the job worker is not registered, the principal can take charge of clearing and managing such waste.

Form GST ITC-04 filing Requirement for Job Work Transactions

Form GST ITC-04 is an essential document that the principal entity needs to submit, outlining crucial details related to their job work transactions. This includes information about goods dispatched to a job worker, goods received from a job worker, and goods sent from one job worker to another.

Form GST ITC-04 is an essential document that the principal entity needs to submit, outlining crucial details related to their job work transactions. This includes information about goods dispatched to a job worker, goods received from a job worker, and goods sent from one job worker to another.

For businesses with an aggregate turnover exceeding 5 crores, the filing of Form GST ITC-04 is a biannual affair, due on the 25th of April and October. However, for those with an aggregate turnover of 5 crore or less, this form is an annual requirement due on the 25th of April each year.

This reporting mechanism ensures transparency and compliance in the realm of job work transactions, ultimately aiding in the seamless functioning of the GST system.

Determining Place of Supply in Job Work: An Illustration

Understanding the place of supply is crucial in a job work transaction. Let’s clarify this using a hypothetical scenario: The principal operates from State A, the job worker from State B, and the recipient from State C.

In a scenario where the supply originates from the job worker’s business premises, the invoice is issued by the principal in State A to the recipient based in State C, the transaction is categorized as an inter-State supply, involving different states.

On the other hand, if the recipient is also situated in State A, it transforms into an intra-State supply within the same state. This distinction is essential for GST compliance, streamlining transactions in the job work domain.

Conclusion

Section 19 of the CGST Act, 2017 is a cornerstone for businesses, granting them the rightful ability to claim input tax credit on goods dispatched for job work. This provision serves to streamline operations seamlessly within the GST framework.

However, compliance is key. The Act lays down specific conditions to ensure adherence to GST regulations, especially when goods sent for job work aren’t returned within the designated timeframes. This emphasis on compliance underscores the significance of understanding and adhering to these provisions for both the principal and the job worker. It’s vital to grasp these nuances to fully leverage the flexibility offered by this act in the realm of job work transactions.

For more details on it, you can follow the link of Indian railways department-https://indianrailways.gov.in/GST/GST-Job%20Work%20Procedure.pdf

You may watch the video for more clarity on this topic by clicking on this Link-https://www.youtube.com/watch?v=RPwHD_2K-K0

You may also Like–https://anptaxcorp.com/revocation-of-gst-registration-cancellation/

Demystifying Cryptocurrency Taxation in India 2023: A Comprehensive Guide