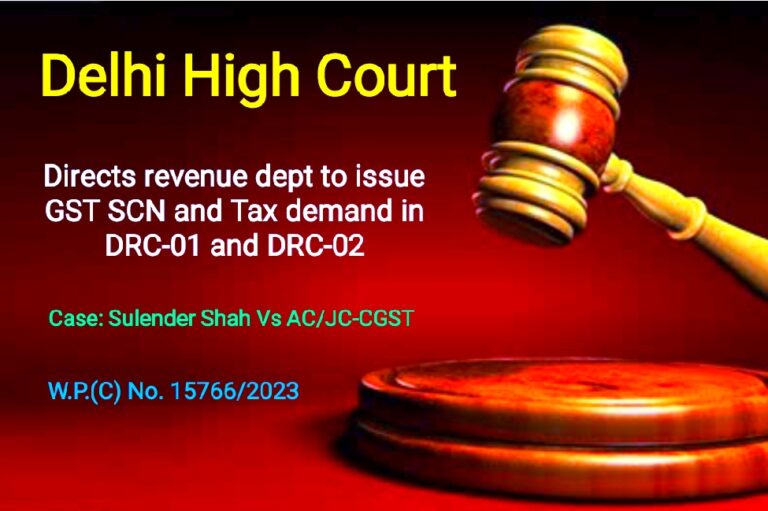

Delhi High Court Directs Revenue Department for Electronic Issuance of GST SCN & Tax Demand in DRC-01 and DRC-02

Direction by Delhi HC to Revenue Department for Electronic Issuance of GST SCN & Tax Demand: In a recent development, the Delhi High Court, in the case of Sulender Shah v. Additional Commissioner/Joint Commissioner CGST [W.P.(C) NO. 15766 OF 2023 dated December 7, 2023], has instructed the Revenue Department to expedite the electronic issuance of SCN (Show Cause Notice) and Tax Demand through Form GST DRC-01 & Form GST DRC-02. This directive underscores compliance with Section 74 of the Central Goods and Services Tax Act, 2017, and Rule 142(1) of the Central Goods and Services Tax Rules, 2017.

Background:

The petitioner, Sulender Shah, filed a writ petition seeking the annulment of the Show Cause Notice dated August 2, 2023 (referred to as the “Impugned Notice”) and a stay on the adjudication proceedings by the Revenue Department until the resolution of the writ petition. The petitioner argued that the issues raised in this petition were previously addressed in the Delhi High Court’s ruling in the case of Shubham Gupta v. Additional Commissioner/Joint Commissioner CGST, and Anr. [W.P.(C) No. 12457/2023 dated September 21, 2023], involving the same issuance of GST SCN.

Key Issue:

The central question revolved around whether, under Section 74 of the CGST Act, the summary of demand and notice must be electronically provided, as stipulated by Rule 142(1) of the CGST Rules.

Relevant CGST Rule 142(1):

Rule 142(1) mandates that the proper officer shall electronically serve a summary along with notices issued under various sections of the CGST Act, including Section 74, using FORM GST DRC-01. Similarly, for statements under specified sections, a summary must be provided electronically in FORM GST DRC-02.

Court Order:

The Delhi High Court, referencing its earlier order in the case of Shubham Gupta, reiterated that under Rule 142(1) of the CGST Rules, any notice issued under Section 74 must be accompanied by an electronically generated summary in Form GST DRC-01 and Form GST DRC-02. The court emphasized that providing the summary electronically, even during the pendency of adjudication proceedings, is sufficient compliance. The proper officer is instructed for prompt issuance of GST SCN i.e., the challenged notice and demand electronically using Form GST DRC-01 & Form GST DRC-02, ideally within a week for expeditious delivery.

Conclusion:

This recent directive from the Delhi High Court underscores the importance of electronic compliance with GST regulations. As per the GST law, issuance of GST SCN and Tax demand is to be done through DRC-01 and DRC-02. Businesses and taxpayers are encouraged to stay informed about such rulings to ensure adherence to statutory requirements and streamline their operations.

To Access the CBIC Notification No. 1/2024 CLICK HERE

READ MORE

Tax Chronicle December 2023 – Key Updates on Latest GST & Income-Tax Developments

GSTN Advisory 620: New Functionalities for Online Filing of Declaration by GTA Taxpayers

Fantastic site Lots of helpful information here I am sending it to some friends ans additionally sharing in delicious And of course thanks for your effort

Thank you so much!