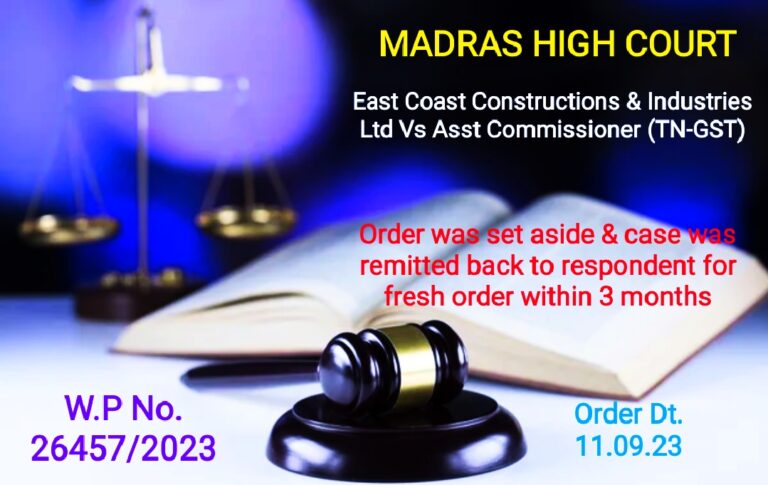

Technical Issues in GST Portal Causing Miscommunication Can Lead to Setting Aside an Order: Madras HC Order Dt. 11.09.2023

Madras HC Sets Aside the Order of Assistant Commissioner Due to Confusing Delivery of Order in GST Portal In a recent legal development, technical issues on the GST portal have played a crucial role in case of East Coast Constructions …