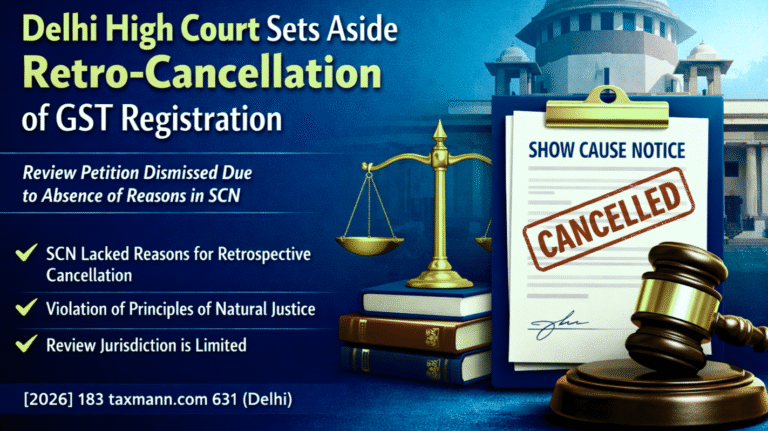

Absent Reasons in SCN: Delhi High Court Sets Aside Retro-Cancellation of GST Registration; Review Petition Dismissed

In a significant ruling strengthening the principles of natural justice in GST proceedings, the Delhi High Court held that retrospective cancellation of GST registration cannot be sustained when the Show Cause Notice (SCN) fails to specify the reasons for such action. The …