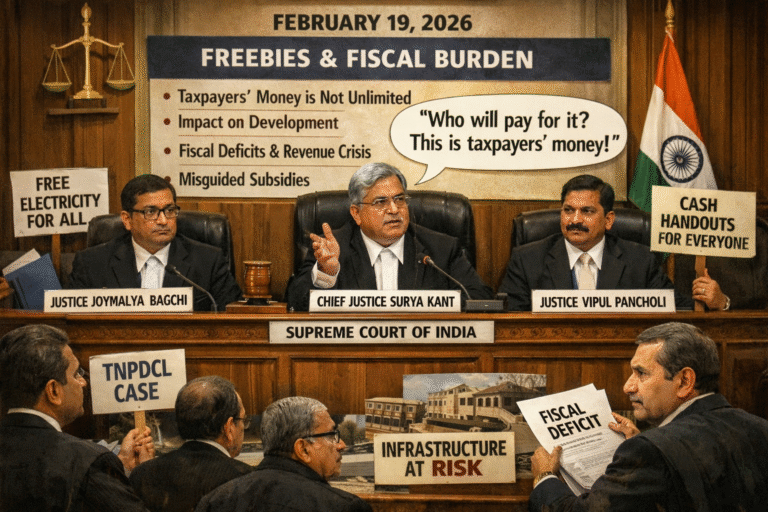

Supreme Court Questions Pre-Election “Freebies” Policy; Flags Taxpayer Burden and Fiscal Discipline Concerns

On February 19, 2026, the Supreme Court of India delivered strong oral observations on the growing trend of pre-election “freebies,” describing them as an “appeasing policy” that may impose an unsustainable burden on taxpayers and strain public finances. A bench …