Form No. 10AB is the statutory application prescribed under the Income-tax Act, 1961 for obtaining, renewing, or modifying registration and approval of charitable or religious trusts, institutions, funds, universities, and research entities under sections 12AB, 10(23C), 80G, and 35.

It was introduced as part of the revamped registration framework effective from 1 April 2021, aimed at standardising the process, bringing all approvals under a common validity period, and ensuring periodic review of eligibility.

This form is filed electronically through the Income-tax e-Filing portal, accompanied by prescribed documents, and is processed by the Jurisdictional Commissioner of Income-tax (Exemptions). Timely and accurate filing of Form 10AB is essential to secure or continue income-tax exemption benefits.

Here’s a complete guide to Form No. 10AB under the Income-tax Act, 1961—what it is, when it’s required, and how the process works.

1. What is Form No. 10AB?

Form 10AB is the application form for registration or approval under sections 12AB, 10(23C), 80G, or 35(1)/(ii)/(iii)/(iia) of the Income-tax Act, 1961.

It is primarily used for:

- Fresh registration/approval for trusts, societies, institutions, funds, or universities.

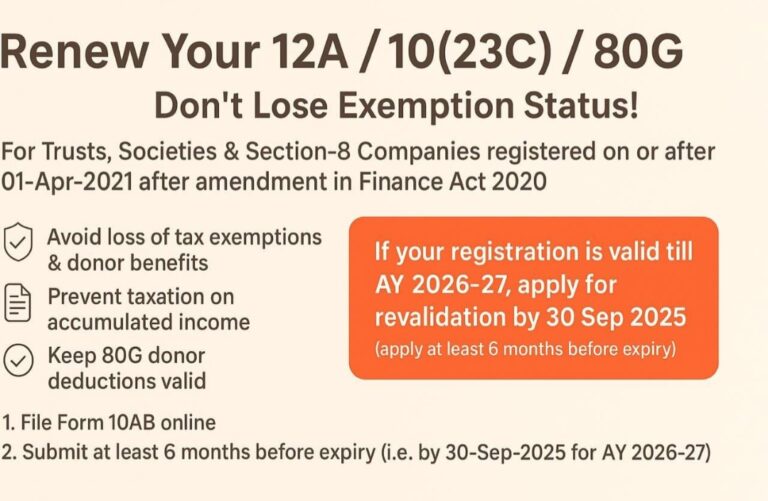

- Renewal/revalidation of existing registrations/approvals (granted for a fixed period, usually 5 years).

- Conversion from provisional to regular registration.

- Modification of objects or activities.

2. Who Needs to File Form 10AB?

You must file Form 10AB in the following situations:

| Situation | Section Reference | Timeline |

|---|---|---|

| Applying for regular registration after provisional registration | 12AB(1)(ac)(ii) | Within 6 months before expiry of provisional registration |

| Applying for renewal/revalidation of existing approval (12A, 80G, 10(23C), 35) | 12AB(1)(ac)(iii)/(vi) | At least 6 months before expiry |

| Registration on modification of objects not conforming to existing conditions | 12AB(1)(ac)(v) | Within 30 days from adoption of new objects |

| Conversion from provisional to regular approval under section 35 | 35(1)/(ii)/(iii)/(iia) | Same as above |

| New registration after cancellation or non-renewal | Relevant section | Before commencement of new approval period |

3. Documents Required for Filing Form 10AB

You will typically need:

- Constitution documents – Trust Deed / Memorandum of Association / Rules & Regulations.

- Registration certificate under relevant law (Societies Registration Act, Indian Trusts Act, Companies Act section 8, etc.).

- PAN of the trust/institution.

- Details of key functionaries – Name, PAN, Aadhaar, contact details.

- Annual accounts for the last 3 years (if applicable).

- Activity reports of past years.

- Proof of adoption of amended objects (if filing for modification).

- Registration/approval under FCRA (if applicable).

4. Step-by-Step Process to File Form 10AB

Step 1: Log in to the Income-tax e-Filing portal using the trust/institution’s credentials.

Step 2: Go to:

e-File → Income Tax Forms → File Income Tax Forms.

Step 3: Search for Form 10AB in the form list.

Step 4: Select the relevant section code (depends on whether applying under section 12AB, 80G, 10(23C), or 35).

Step 5: Fill in details:

- Legal name of the organisation.

- Nature of activities.

- Details of registration under other laws.

- Details of key persons.

- Assets/liabilities.

Step 6: Upload mandatory documents in PDF format (each ≤ 5 MB).

Step 7: Verify using DSC (Digital Signature Certificate) or EVC (Electronic Verification Code) of authorised signatory.

Step 8: Submit the form and note the Acknowledgement Number.

5. Processing & Outcome

- The application is forwarded to the Jurisdictional CIT(Exemptions).

- They may call for additional information or documents.

- Approval/registration is granted in Form 10AC or 10AD.

- If rejected, an order stating reasons will be issued.

6. Relevant Timelines

| Action | Time Limit |

|---|---|

| CIT(E) to pass order | Within 6 months from end of month in which application is received |

| Validity of approval | Normally 5 years (Provisional – 3 years) |

| Renewal | Must be filed 6 months before expiry |

7. Key Points to Remember

- Filing Form 10AB is mandatory for renewal, otherwise your approval lapses and you lose exemption benefits.

- File well before deadlines to avoid rejection due to time-barred application.

- Ensure documents match PAN and legal registration details exactly.

- If your objects change significantly, you must apply again within 30 days—failure can lead to cancellation.