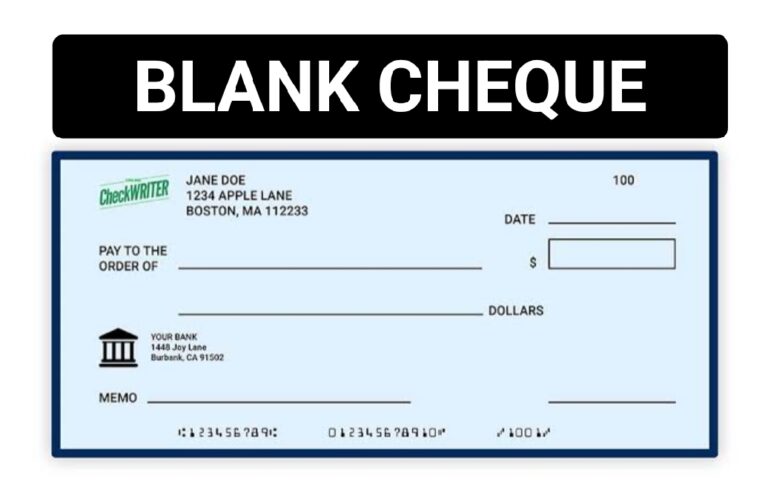

Issuing a blank cheque, where only the signature is affixed and all other particulars are left blank, is a common practice in many business and personal transactions in India. While this might seem risky at first glance, Indian law has laid down clear principles regarding the legality and implications of such instruments.

Is Issuing a Blank Cheque Legal?

Yes, issuing a blank cheque is legally valid if the cheque is signed and voluntarily handed over to the payee, with authorization to fill in the remaining details, such as the amount and date. This practice is covered under Section 20 of the Negotiable Instruments Act, 1881, which recognizes the authority of a holder in due course to complete an inchoate instrument.

Relevance of Section 138 of the Negotiable Instruments Act

Section 138 deals with the dishonour of cheques due to insufficiency of funds or stop payment instructions. When a blank cheque is dishonoured after being duly filled in by the payee, Section 138 still applies, as long as the drawer had voluntarily signed and delivered the cheque.

This was upheld in the Karnataka High Court ruling in S.R. Muralidhar vs G.Y. Ashok [ILR 2001 Kar 4127], where the court held that once a signed blank cheque is handed over to the payee with the authority to fill in the details, the legal presumption under Section 118(a) and Section 139 of the NI Act applies — i.e., the cheque was issued for the discharge of a legally enforceable debt or liability.

Defence by the Accused: Old Cheque Misuse Allegation

A frequent defence taken by accused persons in cheque bounce cases is that the cheque was issued long ago and misused later, beyond its validity period. In such scenarios, courts have held that it becomes crucial to determine:

- The age of the ink and handwriting

- Whether the cheque was indeed signed recently or in the distant past

If the accused raises such a claim, the court may send the cheque for forensic analysis to determine the age of ink and writing. This principle was established in Kalyani Bhasker vs M.S. Sampoornam [(2007) 2 SCC 258] and followed in T. Nagappa vs Y.R. Muralidhar [AIR 2008 SC 2010; (2008) 5 SCC 633].

Presumption in Favour of Holder

The Supreme Court in Bir Singh vs Mukesh Kumar [(2019) 4 SCC 197] delivered a landmark ruling stating that:

“A cheque duly signed and voluntarily handed over by the drawer carries the presumption that it was issued in discharge of debt or liability, regardless of whether it was post-dated or blank at the time of handing over.”

The court further emphasized that unless there is evidence of coercion, fraud, or undue influence, the presumption under Section 139 remains intact.

Latest Judicial View: Kalamani Tex Case

In the more recent decision of Kalamani Tex & Anr. vs P. Balasubramanian [(2021) 5 SCC 283], the Supreme Court reinforced the view that:

“If the accused voluntarily signed and delivered a cheque, the statutory presumption under Section 118 and Section 139 of the NI Act will apply.”

This case underlined that the burden of rebutting the presumption lies on the accused, and it must be discharged with credible evidence, not mere denial or weak explanations.

Key Takeaways

- A blank but signed cheque, if given voluntarily to a payee, is legally valid under Indian law.

- If the cheque is dishonoured, Section 138 of the NI Act is applicable.

- Courts presume the cheque was issued for a valid liability, and it is up to the accused to rebut that presumption.

- The age of ink and handwriting may be examined if misuse of an old cheque is alleged.

- Recent Supreme Court judgments have strengthened the legal standing of payees holding such cheques.

Conclusion

Issuing a blank cheque is a practice recognized by Indian courts, but it comes with inherent legal responsibilities. Once voluntarily handed over, such a cheque carries a strong presumption of liability. Hence, both drawers and payees must exercise caution and maintain clear documentation in their financial dealings to avoid legal disputes.