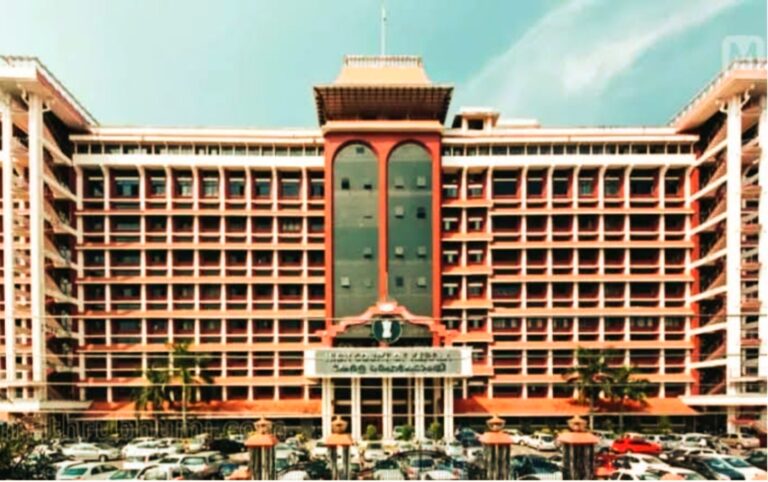

Kerala High Court Upholds Income Tax Department’s Seizure of Rs 1 Crore from CPI(M) Ahead of 2024 General Elections

The Kerala High Court has declined to interfere with the Income Tax Department’s seizure of Rs 1 crore from the bank account of the Communist Party of India (Marxist) [CPI(M)] Thrissur District Committee. The funds were frozen in the Bank …