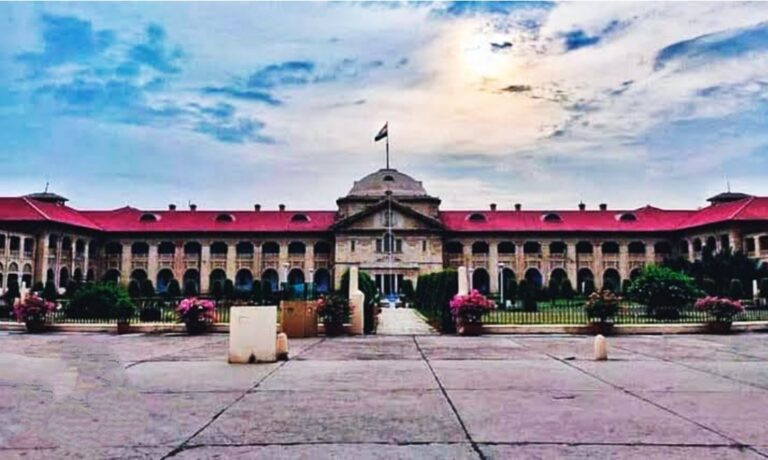

Quasi-Judicial Order Must Allow an Opportunity to Be Heard: Allahabad HC Ruling

The bench concluded that the applicant suffered significant prejudice due to procedural lapses. Consequently, the impugned order was quashed. Quasi-Judicial Orders: The Allahabad High Court, in the case of Agmotex Fabrics Private Limited vs. State of Uttar Pradesh (W.T. No. …