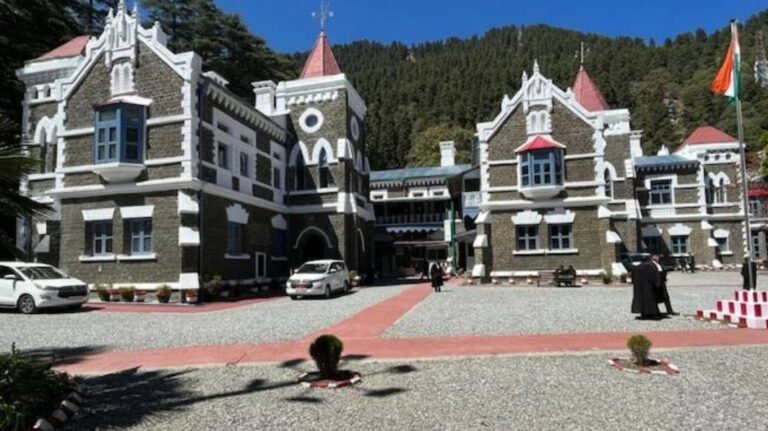

Court Rulings supporting Validity of Serving Demand Notice via Email and WhatsApp for Dishonored Cheques under Section 138 of NI Act

In a significant development in cheque bounce cases, the Allahabad High Court in 2024 ruled that a demand notice sent via email or WhatsApp is legally valid, provided it meets the conditions under Section 13 of the Information Technology Act, 2000. This verdict modernizes legal …